- 20 Marks

AT – Nov 2021 – L3 – Q4 – Business income – Corporate income tax | Minerals and mining

Compute the chargeable income and tax payable for Akwatia Gold Mines for 2020 and identify tax optimization opportunities.

Question

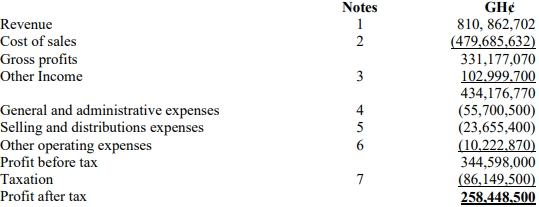

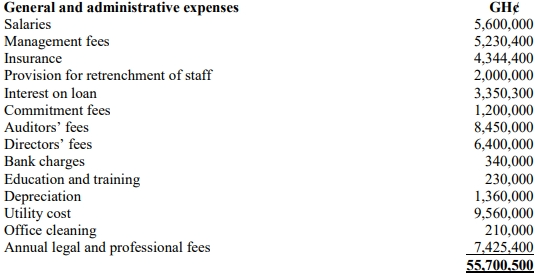

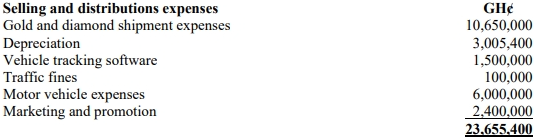

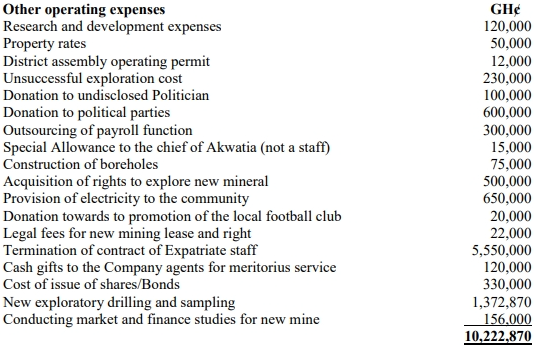

Akwatia Gold Mines was established ten years ago. For the year ended 31 December 2020, the following income statement was prepared and submitted to the Ghana Revenue Authority as part of its financial statement.

Akwatia Gold Mines

Income Statement for the Year Ended 31/12/2020

1.

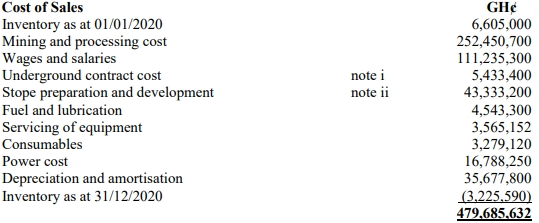

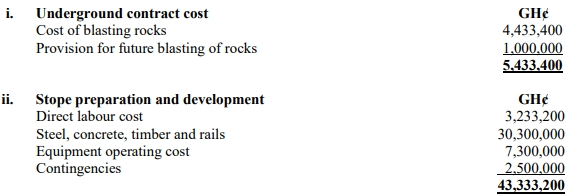

2.

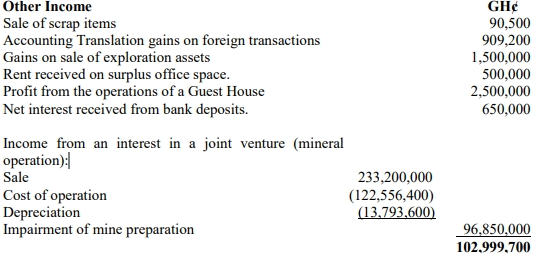

3.

4.

5.

6.

7.

The capital allowance agreed for the period was GH¢24,320,500.

Required:

a) Compute the chargeable income of the company and the tax payable. (15 marks)

b) Advise Akwatia Gold Mines on how to identify opportunities within the tax laws to optimise tax payable for the year ended 31 December 2020. (5 marks)

Find Related Questions by Tags, levels, etc.

Report an error