- 30 Marks

TAX – Nov 2015 – L2 – Q1 – Companies Income Tax (CIT)

Discussing taxation and capital allowance claims of Quickfix Limited for several years of assessment and computation of total profits and tax payable.

Question

Quickfix Limited deals in the sale of Sweetmilk brand of drink. The company commenced business on 1 May 2000. Due to the prohibitive cost of doing business in Nigeria, it decided to cease business on 1 July 2012. The following information was extracted from its records:

| Year of Assessment | Assessable Profit/(Loss) | Capital Allowance | Total Profit | Tax Paid |

|---|---|---|---|---|

| 2007 | (1,921,400) | 4,681,450 | – | – |

| 2008 | 3,942,000 | 5,817,000 | 1,314,000 | 394,200 |

| 2009 | 9,201,750 | 4,168,500 | 3,067,250 | 920,175 |

| 2010 | 7,581,750 | 6,633,000 | 2,527,250 | 758,175 |

| 2011 | 11,580,750 | 9,058,000 | 3,860,250 | 1,158,075 |

| 2012 | 4,664,375 | 4,190,500 | 1,554,790 | 466,438 |

The company made a claim for unutilized capital allowances to be carried back. During the period, 1 January to 30 June 2013, the adjusted loss of the company was N1,614,500. Capital Allowance due was N2,561,250.

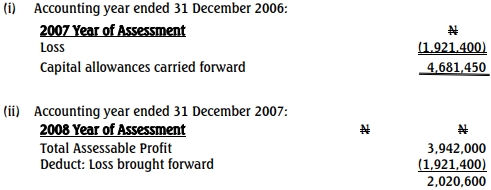

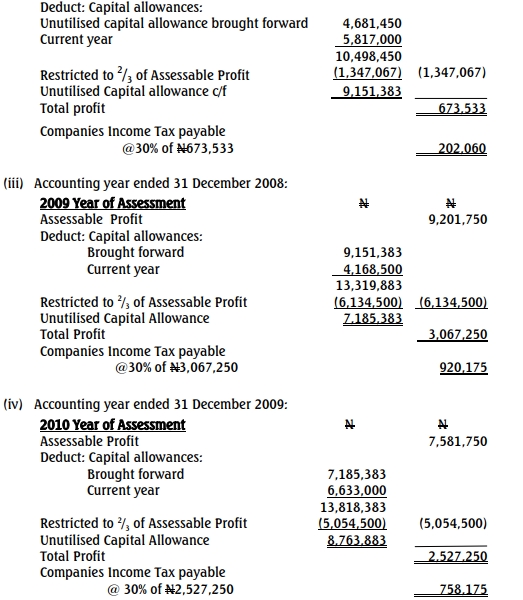

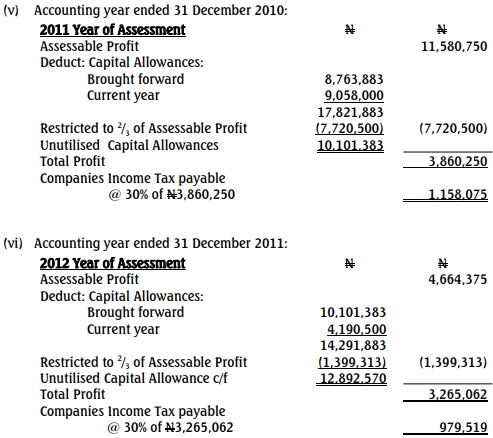

The tax computations as agreed are as follows:

Required:

a. Compute the revised assessment of Quickfix Limited on cessation basis, taking into account unutilized capital allowances.

b. Determine the tax refundable by the Federal Inland Revenue Service (FIRS) for the relevant years of assessment.

Find Related Questions by Tags, levels, etc.

- Tags: Capital allowances, Companies Income Tax, Loss Carryback

- Level: Level 2

- Topic: Companies Income Tax (CIT)

- Series: NOV 2015