- 20 Marks

PSAF – MAY 2019 – L2 – Q3 – Accounting for Government Assets and Liabilities

Record transactions and prepare financial statements for a college loan fund, including ledger accounts, trial balance, and statement of changes.

Question

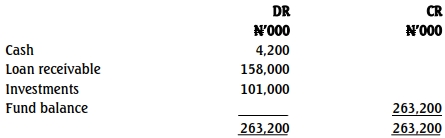

The following balances were extracted from the ledger of YOHAFI College of Technology in respect of Senator Momeed Memorial Loan Fund (MMLF) as at31 December 2017

The following transactions took place in 2018:

(i.) Investment costing N30,800,000 were sold for N31,900,000; (ii.) N30,700,000 cash was received as the repayment of loans; (iii.) N2,500,000 was received from the family of a former student in full payment of a loan which had earlier been written off; (iv) N41,800,000 was given out as loan during the year; (v.) A loan of N750,000 was written-off as uncollectible; and (vi.) A sum of N3,000,000 cash was received as a gift from a former borrower.

You are required to:

a. Open necessary ledger accounts to record above transactions. (13 Marks)

b. Extract a trial balance as at the end of the period. (4 Marks)

c. Prepare a statement of changes in the fund balance. (3 Marks)

Find Related Questions by Tags, levels, etc.