- 15 Marks

CR – May 2018 – L3 – Q3 – Corporate Reconstruction and Reorganisation

Evaluate two schemes for restructuring a microfinance company and discuss the advantages of each scheme.

Question

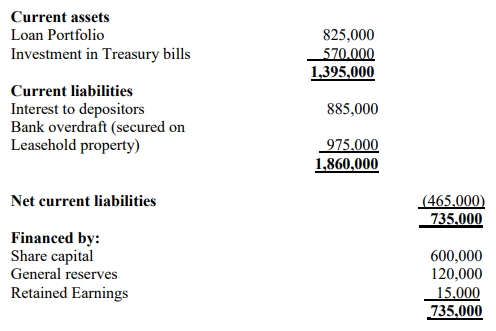

Bank of Ghana (BoG) recently announced an increase in the minimum capital requirement for Micro Finance Institutions in the country from GH¢500,000 to GH¢2 million by June 2018. Capital Link, a Micro Finance Company, has been affected by the increase in players in the Micro Finance Industry, which has seen a reduction of its loan portfolio and an increase in loan default rate. A statement of financial position recently prepared by Capital Link is provided:

Statement of Financial Position as at 30th April 2017

Additional information: Depositors are uncertain about the ability of Capital Link to raise the required capital. Management of Capital Link has proposed two options for the company’s future:

- Scheme 1 – Close Down Mission:

Unity Capital Ltd has offered GH¢600,000 for the leasehold property. The loan portfolio is conservatively valued at GH¢592,500 in a forced sale. Investments in Treasury bills are valued at GH¢465,000. Liquidation expenses are estimated at GH¢30,000, and interest to depositors is GH¢330,000. - Scheme 2 – Rescue Mission:

Management has proposed to implement a rescue scheme that includes a GH¢600,000 loan from a distress fund set up by an NGO. The loan terms include paying GH¢375,000 to the NGO immediately, with the balance exchanged for a 20% debenture repayable over four years.

Assume:

- Current borrowing rate is 14%.

- The present value of GH¢1 receivable at the end of each year is:

| Year | 14% | 20% |

|---|---|---|

| 1 | 0.88 | 0.83 |

| 2 | 0.77 | 0.69 |

| 3 | 0.67 | 0.58 |

| 4 | 0.59 | 0.48 |

Required:

a) By means of numerical analysis of the two schemes, evaluate how much the bank would recover from each scheme. (12 marks)

b) Discuss TWO advantages of each scheme. (3 marks)

Find Related Questions by Tags, levels, etc.