- 20 Marks

AAA – Nov 2020 – L3 – Q2 – Audit Completion and Final Review

Requirements of ISA 450 for uncorrected misstatements, including discussions on litigation, restructuring, and depreciation adjustments.

Question

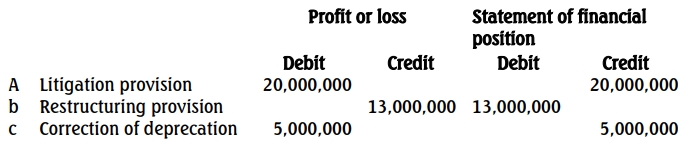

You are the engagement partner on the audit of Uchenna & Associates. The audit senior sent you the schedule of uncorrected misstatements, shown below, including notes to explain each matter in the schedule. Profit or loss Statement of financial position is as follows:

The audited financial statements recognized revenue of N250 million and total assets of N1.24 billion. The materiality threshold was determined as N12.5 million.

You are holding a meeting with management tomorrow, at which the uncorrected misstatements will be discussed.

Notes:

- Litigation Provision: Uchenna & Associates was involved in a dispute over goods quality, resulting in a court judgment against them for N20 million. Uchenna & Associates has appealed the judgment, and its solicitors are confident of a favorable outcome. Management has not recognized the provision, believing they are likely to win. The audit conclusion is that a provision should be included in the financial statements.

- Restructuring Provision: Management recognized a provision for closing one of its factories. Although the board approved the closure in April 2019, no employee announcements were made. The audit conclusion is that the provision should not be recognized.

- Depreciation Correction: The audit team’s recomputation identified an understatement of N5,000,000 in depreciation expense.

Required:

a. Explain the requirements of ISA 450: Evaluation of Misstatements Identified during the Audit, with regard to uncorrected audit misstatements. (15 Marks)

b. Discuss the matters to be addressed with management for each uncorrected misstatement. (5 Marks)

Find Related Questions by Tags, levels, etc.