- 15 Marks

FR – Nov 2014 – L2 – Q2b – Consolidated Financial Statements (IFRS 10)

Compute performance and investment ratios to evaluate financial performance.

Question

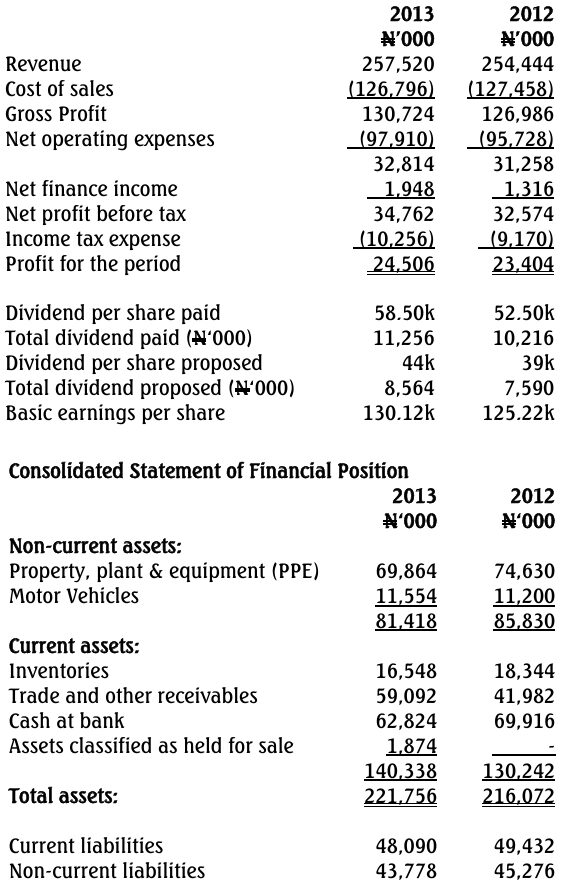

You are provided with the following set of amended published Financial Statements of HAMMED Plc for the year ended 31 December 2013:

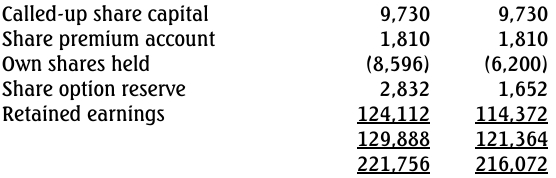

Capital and Reserves Attributable to

equity shareholders:

Additional information:

- The issued share capital of the company consists of 50k ordinary shares.

- The market price of the ordinary shares was N17 at 31 December 2012 and N19.16 at 31 December 2013.

- There were no preference shares and no loan notes.

- The cost of purchases plus production cost was N124,966,000 in 2012 and N125,000,000 in 2013.

- Other opening and closing balances:

| Description | Closing 2013 (N’000) | Closing 2012 (N’000) | Opening 2012 (N’000) |

|---|---|---|---|

| PPE accumulated depreciation | 37,046 | 129,540 | 122,288 |

| Inventories | 16,548 | 18,344 | 20,836 |

| Trade receivables | 40,486 | 37,160 | 35,678 |

| Trade payables | 9,604 | 12,882 | 11,412 |

| Other taxes and social security | 3,822 | 3,640 | 3,818 |

| Accruals | 30,740 | 27,810 | 27,680 |

| Equity | 129,888 | 121,364 | 106,274 |

Required:

i. Calculate performance (efficiency) and investment ratios for each of the two years as far as the available information permits. (10 Marks)

ii. Comment on the company’s financial performance for the year ended 31 December 2013 based on the ratios. (5 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Financial Ratios, Financial Statements, Investment Ratios, Performance

- Level: Level 2

- Topic: Consolidated Financial Statements (IFRS 10)

- Series: NOV 2014

Report an error