- 20 Marks

FM – Nov 2020 – L3 – Q6 – Dividend Policy

Evaluates the dividend payout and investment appraisal for Binko Industrial Services based on Modigliani and Miller's dividend policy, considering four potential projects.

Question

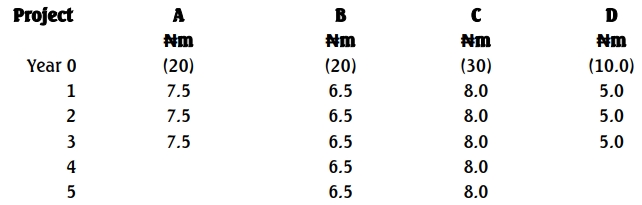

Binko Industrial Services plc is an all-equity financed and Stock Exchange-listed company. Recently, there have been changes at the board level, prompting a shift from conservative profit distribution to seeking new investment opportunities. In the financial year just ended, the company reported a profit of ₦50 million, similar to previous years. The company’s cost of equity is 15% per annum, and four investment projects have been identified, each with the same risk class as existing projects.

Required:

a. Calculate the dividend Binko Industrial Services plc should pay to shareholders in the financial year just ended, based on Modigliani and Miller’s 1961 proposition, ignoring taxation. (5 Marks)

b. Prepare notes for the board meeting, explaining Modigliani and Miller’s dividend policy proposition and reasons why the company may decide against the calculated dividend in (a). Your comments should address Binko’s circumstances. Work to the nearest ₦1,000. (15 Marks)

Find Related Questions by Tags, levels, etc.