- 10 Marks

AT – Nov 2016 – L3 – Q1a&b – Business income – Corporate income tax

Calculate the tax due to GRA for the year 2014 based on the income statement of Samada Insurance Company.

Question

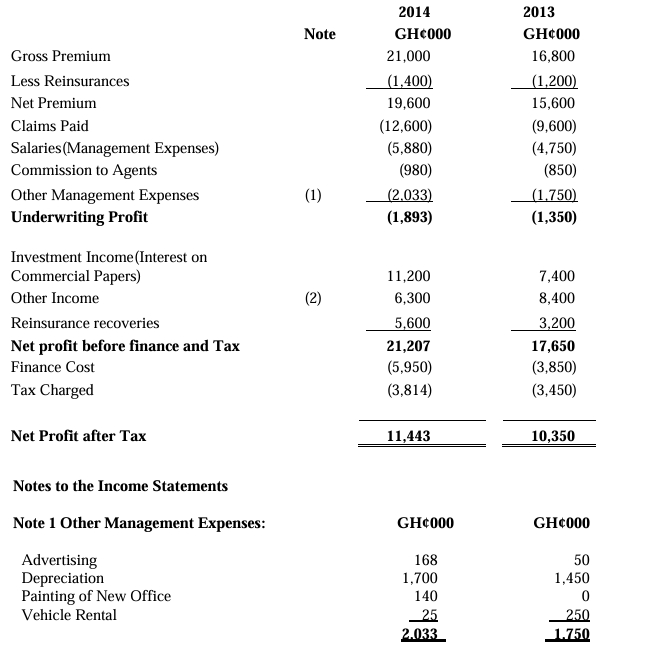

You have been appointed as the Tax Manager of Samada Insurance Company. The Executive Director has expressed his persistent worry with the Chief Accountant to accurately calculate the company’s tax obligations to agree with what is assessed by the Ghana Revenue Authority each year. He has thus, provided you with the Income Statement below for your consideration and advice.

SAMANDA INSURANCE COMPANY LIMITED

Income Statement for the years ended 2013 and 2014

- Additional Information:

i) Capital allowance agreed for the year 2014 was GH¢2,450,000

ii) Reserve is calculated at 40% of Net premium.

Required:

a) Compute the tax due to the GRA for 2014 year of Assessment. (8 marks)

b) Support your computations with relevant explanations. (2)

Find Related Questions by Tags, levels, etc.

Report an error