- 15 Marks

FM – Nov 2016 – L3 – Q6 – Strategic Performance Measurement

Evaluate Osamco Limited's financial performance and discuss reasons for its potential stock exchange listing.

Question

Osamco Limited, a manufacturer of wire and cables, was bought from its conglomerate parent company in a management buyout deal in August 2010. Six years later, the managers are considering the possibility of listing the company’s shares on the Nigerian Stock Exchange.

The following financial information is made available:

OSAMCO LIMITED

Income Statement for the Year Ended June 30, 2016

| Item | Amount (N’million) |

|---|---|

| Turnover | 91.25 |

| Cost of sales | (79.00) |

| Profit before interest and taxation | 12.25 |

| Interest | (3.25) |

| Profit before taxation | 9.00 |

| Taxation | (1.25) |

| Profit attributable to ordinary shareholders | 7.75 |

| Dividend | (0.75) |

| Retained profit | 7.00 |

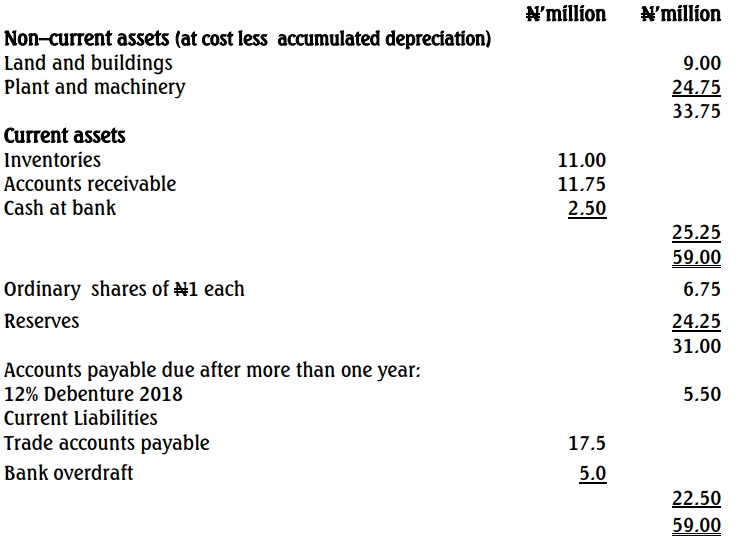

Statement of Financial Position as at June 30, 2016

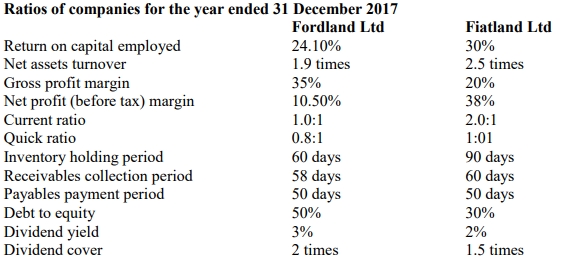

Average performance ratios for the industry sector in which Osamco Limited operates are as stated below:

Industry Sector Ratios

| Ratio | Industry Average |

|---|---|

| Return before interest and tax on long-term capital employed | 24% |

| Return after tax on equity | 16% |

| Operating profit as a percentage of sales | 11% |

| Current ratio | 1.6:1 |

| Quick (acid test) ratio | 1.0:1 |

| Total debt: equity (gearing) | 24% |

| Dividend cover | 4.0 |

| Interest cover | 4.5 |

Required:

- (a) Evaluate the financial state and performance of Osamco Limited by comparing it with that of its industry sector. (10 Marks)

- (b) Discuss four probable reasons why the management of Osamco Limited is considering Stock Exchange listing. (5 Marks)

Find Related Questions by Tags, levels, etc.

Report an error