- 30 Marks

CR – May 2015 – L3 – Q1 – Consolidated Financial Statements (IFRS 10)

Prepare a consolidated statement of financial position for Barewa Group as of 31 May 2013, considering acquisitions and adjustments.

Question

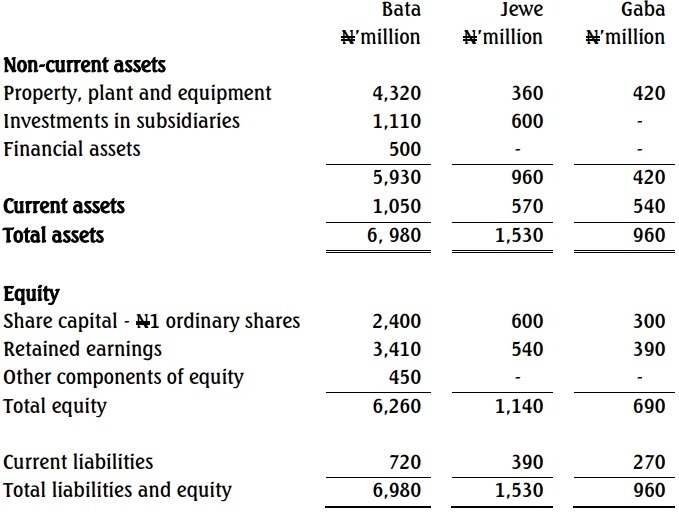

Barewa Plc has two subsidiary companies and one associate. Since the adoption of International Financial Reporting Standards (IFRS) by companies listed on the Nigeria Stock Exchange, Barewa has been preparing its consolidated financial statements in accordance with the provisions of International Financial Reporting Standards (IFRSs).

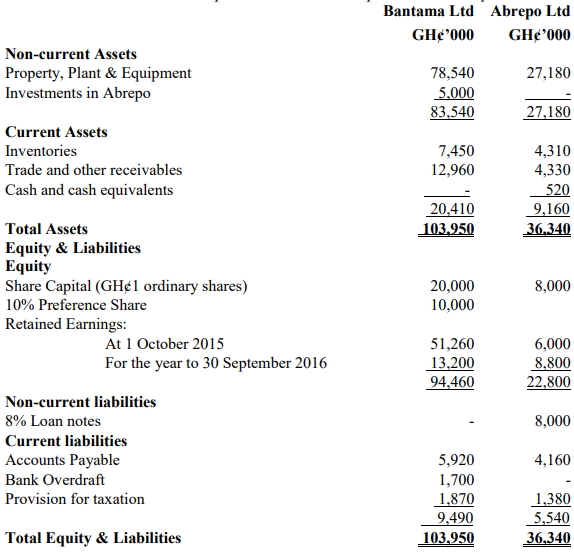

The draft Statements of Financial Position of Barewa and its two subsidiaries as at 31 May, 2013 are as follows:

| Assets | Barewa (N’m) | Megida (N’m) | Mindara (N’m) |

|---|---|---|---|

| Non-current assets | |||

| Plant | 2,650 | 2,300 | 1,610 |

| Investments – Megida | 3,000 | ||

| Investments – Mindara | 1,280 | ||

| Associate (Calamari) | 200 | ||

| Available for sale | 510 | 60 | 50 |

| Total Non-current assets | 7,640 | 2,360 | 1,660 |

| Current assets | |||

| Inventory | 1,350 | 550 | 730 |

| Trade receivables | 910 | 450 | 320 |

| Cash and cash equivalent | 1,020 | 1,000 | 80 |

| Total Current assets | 3,280 | 2,000 | 1,130 |

| Total Assets | 10,920 | 4,360 | 2,790 |

| Equity and Liabilities | |||

|---|---|---|---|

| Share capital | 5,200 | 2,200 | 1,000 |

| Retained earnings | 2,400 | 1,500 | 800 |

| Other components of equity | 120 | 40 | 70 |

| Total equity | 7,720 | 3,740 | 1,870 |

| Non-current liabilities | |||

| Long-term loans | 1,200 | 150 | 50 |

| Deferred tax | 250 | 90 | 30 |

| Total non-current liabilities | 1,450 | 240 | 80 |

| Current liabilities | |||

| Trade payables | 1,150 | 300 | 600 |

| Current tax payables | 600 | 80 | 240 |

| Total current liabilities | 1,750 | 380 | 840 |

| Total Equity and Liabilities | 10,920 | 4,360 | 2,790 |

The following information is relevant to the preparation of the group financial statements:

- Acquisition of Megida Plc

- Date of Acquisition: 1 June 2012

- Barewa acquired 80% of the equity interest in Megida Plc.

- At the date of acquisition, Megida’s retained earnings were N1.36 billion, and other components of equity amounted to N40 million.

- There had been no new issuance of share capital by Megida since the acquisition date.

- The consideration for the acquisition was N3 billion in cash.

- The fair value of Megida’s identifiable net assets at acquisition was N4 billion, with the excess attributed to an increase in the value of non-depreciable land.

- An independent valuation determined that the fair value of the non-controlling interest (NCI) in Megida on 1 June 2012 was N860 million.

- Barewa’s policy is to measure NCI based on their proportionate share in the identifiable net assets of the subsidiary, not at fair value (full goodwill method).

- Acquisition of Mindara Plc

- Date of Acquisition: 1 June 2012

- Barewa acquired 70% of the ordinary shares of Mindara Plc.

- The consideration for the acquisition included:

- An upfront payment of N1.28 billion.

- A contingent consideration requiring Barewa to pay the former shareholders 30% of Mindara’s profits on 31 May 2014 for each of the financial years ending 31 May 2013 and 31 May 2014. This arrangement was valued at N120 million as of 1 June 2012 and remains unchanged. It has not been included in the financial statements.

- The fair value of the identifiable net assets at acquisition was N1.76 billion. This included retained earnings of N550 million and other components of equity of N70 million.

- There had been no new issuance of share capital by Mindara since the acquisition date.

- The excess fair value of the net assets was due to an increase in property, plant, and equipment (PPE), which is depreciated on a straight-line basis over seven years.

- The fair value of the non-controlling interest (NCI) in Mindara was N530 million on the acquisition date.

- Investment in Calamari Plc

- On 1 June 2011, Barewa acquired a 10% interest in Calamari Plc for N80 million. This was classified as an available-for-sale investment.

- As of 31 May 2012, the value of this investment had increased to N90 million.

- On 1 June 2012, Barewa acquired an additional 15% interest in Calamari for N110 million, achieving significant influence.

- Calamari recorded profits after dividends of N60 million and N100 million for the financial years ending 31 May 2012 and 31 May 2013, respectively.

- Equity Instrument Purchase

- On 1 June 2012, Barewa purchased an equity instrument valued at 100 million pesos, classified as available-for-sale.

- Relevant exchange rates:

- 31 May 2012: N5.1 to 1 peso.

- 31 May 2013: N5.0 to 1 peso.

- The fair value of the instrument as of 31 May 2013 was 90 million pesos, reflecting an impairment that Barewa has not recorded.

- Loan to a Director

- A loan of N10 million to a director has been included in cash and cash equivalents.

- The loan is repayable on demand with no specific repayment date.

- The directors believe that this treatment complies with International Financial Reporting Standards (IFRS), as no IFRS explicitly prohibits showing the loan as cash.

- Goodwill Impairment

- There is no impairment of goodwill arising from the acquisitions.

Required

Prepare a consolidated statement of financial position for Barewa Group as of 31 May 2013.

Find Related Questions by Tags, levels, etc.

Report an error