- 20 Marks

AAA – May 2019 – L3 – Q4 – Review of Subsequent Events and Going Concern Assumptions

Analyze the auditor's objectives, implications of going concern assumptions, directors' responsibilities, and risk assessment for going concern status.

Question

Itanforiti Publishers Limited has been in the printing and publishing business for many years in Ibadan. The company has been performing well with a competitive advantage over many companies in the industry as a result of the engagement of a high-profile team of personnel and in-house printing of its published books.

The board of directors comprises two brothers and their wives. The older brother is the chairman, and the younger, the managing director. The fortunes of the company started dwindling in 2013 when conflicts could no longer be resolved amicably among the members of the board of directors.

The chairman, being a majority shareholder, assumed executive powers by combining the roles hitherto played by the managing director with his own as executive chairman in 2015. Governance of the company became unsettled, and key staff of the organization started resigning in turn.

In 2016, the financial reports of the company revealed its inability to pay creditors, and the supply of raw materials became irregular. In addition, the level of receivables became too high with a significant figure of doubtful and irrecoverable debts.

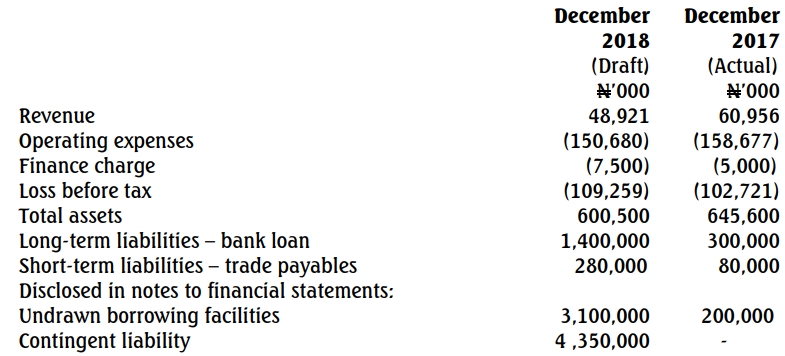

Your firm acts as auditors to the company, and you have been presented with the financial statements for the year ended 31st December 2017, for audit. The financial statements were prepared on a going concern basis.

Required:

a. Identify and explain the objectives of the auditor in the area of going concern in accordance with International Standards on Auditing (ISA 570). (5 Marks)

b. Explain the going concern assumption and the implications for the financial statements if the entity is not a going concern. (5 Marks)

c. Explain the going concern duties of the directors. (3 Marks)

d. Evaluate the risk assessment procedures to be performed by the auditor on the going concern status of the entity. (ISA 570). (7 Marks)

Find Related Questions by Tags, levels, etc.