- 8 Marks

ATAX – May 2016 – L3 – Q7b – Taxation of Non-Resident Companies and Individuals

Compute the tax liabilities payable in Nigeria for Apex Communications Limited, a foreign company with income originating, routed, and terminating in Nigeria.

Question

Apex Communications Limited is a British company engaged in the business of transmission of messages by cable or any other form of wireless technology.

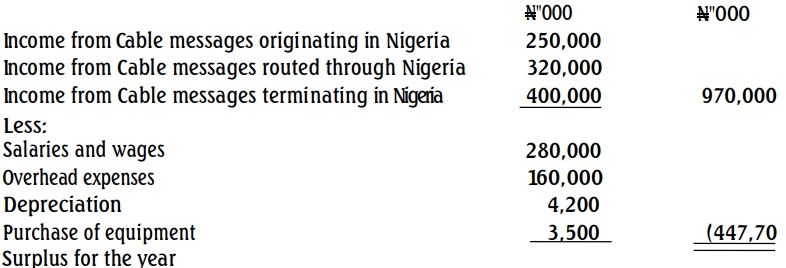

Its worldwide operating results for the year ended December 31, 2014, are as follows:

You are provided with the following information:

(i) The British Tax Authority has certified the Adjusted Profit and Depreciation allowance ratios.

(ii) Included in Overhead Expenses are disallowable items totaling ₦12,500,000.

(iii) The Federal Inland Revenue Service is satisfied that tax is computed and assessed in Britain, the home country of the foreign company, on the same basis as Nigeria.

You are required to:

Compute the Tax Liabilities payable by the company in Nigeria for the relevant assessment year. (8 marks)

Find Related Questions by Tags, levels, etc.