- 7 Marks

ATAX – May 2019 – L3 – Q5c – Double Taxation Reliefs and Credits

Advise on double taxation relief for SOKGlobal Limited and compute the applicable relief.

Question

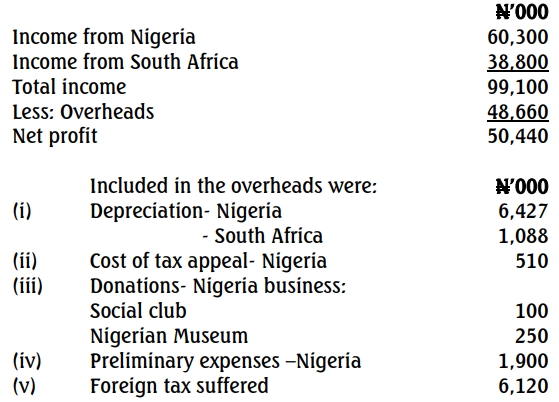

SOKGlobal Limited is a wholly owned Nigerian company that deals with stationery items. It has a functional business unit in Cape Town, South Africa. The company’s operating results for the year ended December 31, 2017, are as follows:

Profit attributable to South Africa business: ₦8,740

Capital allowances agreed with tax officials for Nigeria and South Africa businesses were ₦5,500,000 and ₦2,210,000, respectively.

Required:

Advise the company on the double taxation relief applicable to the company, showing the necessary computations.

Find Related Questions by Tags, levels, etc.

Report an error