- 20 Marks

PSAF – Nov 2018 – L2 – Q3a – Public sector fiscal planning and budgeting

Prepare a budget for 2019 using 2018 as a base and analyze the budgeting approach.

Question

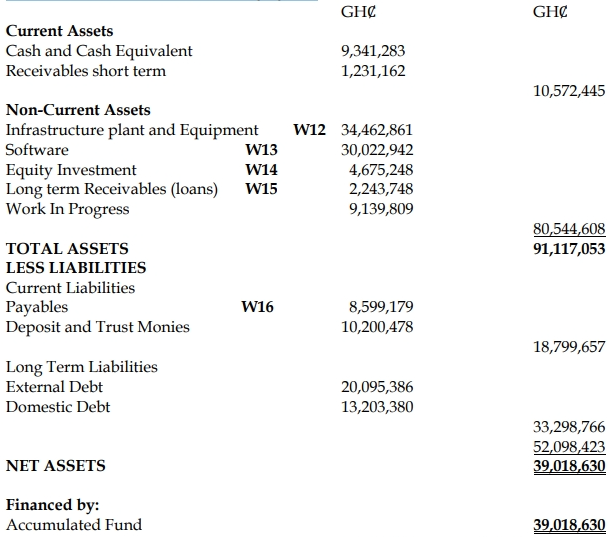

a) You are the head of the Budget department of the Ministry of Works. The Ministry intends to prepare the budget for the 2019 fiscal year and has intended to use the 2018 budget as a base. Below is the detail of the 2018 Budget:

Assumptions for 2019 Budget: i) The Ministry has introduced new equipment, leading to a 36% increase in IGF, but government grants will be cut by GH¢9,600,000. ii) Established post salary will increase by GH¢3,920,000, non-established post salaries will increase to GH¢4,960,000, and allowances will increase by 15%. iii) Utility cost will decrease to GH¢9,700,000; repairs cost will increase by 9%; and training and seminar cost will increase to GH¢17,820,000. iv) The Ministry expects to acquire new equipment, increasing the equipment cost by GH¢150,000,000.

Required: Using the 2018 Budget as a base and assumptions made, prepare the Budget for the 2019 fiscal year. (10 marks)

b)

i) Identify and explain the type of Budget approach used by the Ministry in the Budget preparation. (2 marks)

ii) Explain THREE (3) merits and THREE (3) demerits of the Budget approach adopted in the preparation of the 2019 Budget. (3 marks)

iii) Explain an alternative approach you would have suggested to the Ministry for their subsequent budget preparation and explain THREE (3) reasons why that approach is appropriate under the circumstance. (5 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Budget Preparation, Fiscal Year 2019, Incremental Budgeting, Public Sector

- Level: Level 2

- Topic: Public sector fiscal planning and budgeting

- Series: NOV 2018