- 20 Marks

AAA – May 2021 – L3 – Q6 – Review of Subsequent Events and Going Concern Assumptions

Evaluation of going concern issues at Wazobia Nigeria Limited and audit procedures to address identified risks.

Question

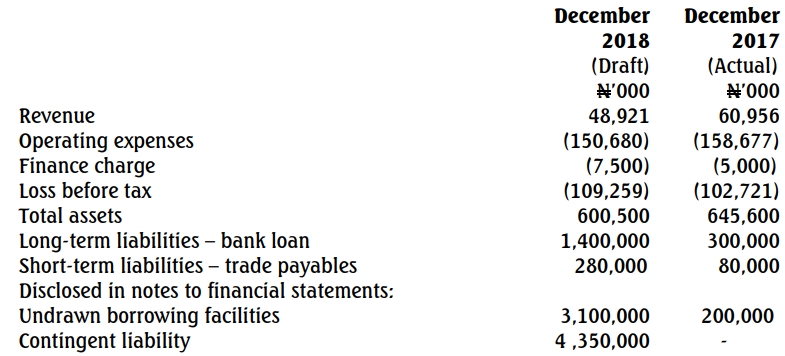

Wazobia Nigeria Limited is a manufacturer of corrugated zinc roofs. Due to the economic recession, revenue continued to decline each year for the past three years. You are aware that the company had only N300,000 in cash at the year end. Extracts from the draft financial statements and other relevant information are given below.

Additional information:

(i) The bank loan was obtained in 2016 when the company started recording losses. The collateral for the loan is a fixed and floating charge on the assets of the company to the tune of the loan balance. The first tranche of repayment of the loan is due in 2019 and the amount repayable is N300 million.

(ii) Wazobia renegotiated its credit line with a major supplier and extended payment terms from 60 days to 90 days in order to improve working capital.

(iii) The terms for accessing the undrawn facilities stipulate that the company must meet certain covenants, including that interest cover is maintained at 2:1 and the ratio of bank loan to total assets does not exceed 1:1.

(iv) The contingent liability relates to litigation against the company by one of its customers for an alleged breach of contract to supply roofing sheets based on agreed specifications.

Required:

(a) Identify and explain the matters which may cast significant doubt on the company’s ability to continue as a going concern in the foreseeable future. (10 Marks)

(b) Recommend the appropriate audit procedures to be performed to adequately address the going concern matters identified. (10 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Audit Procedures, Bank Loan, Contingent Liabilities, Financial Stress, Going Concern

- Level: Level 3