Carrol Nigeria Limited, a medium-sized company, commenced business in 2011. The company has three subsidiaries in the manufacturing of household utensils and baby products. Over the last three years, its fortunes have dwindled due to high costs of imported raw materials, overheads, low patronage from customers, and increasing demands from the host communities for social amenities.

Due to the challenging business environment, the board decided in 2016 to reduce workforce and permanently close one of its subsidiaries. This led to the appointment of a young accountant with limited taxation and fiscal policy knowledge as the Group Accountant after two Finance Department staff were affected.

In the past three years, the company faced challenges with tax authorities on tax compliance. The Group Managing Director was embarrassed when informed by the tax officer that essential records necessary for determining tax liabilities were not maintained. Gaps were also observed in the annual returns filed by the company, and the Revenue Service is conducting a back duty audit.

The Group Managing Director has sought assistance in addressing these challenges and provided documents for recomputation of the company’s income tax liabilities for the year ended December 31, 2020.

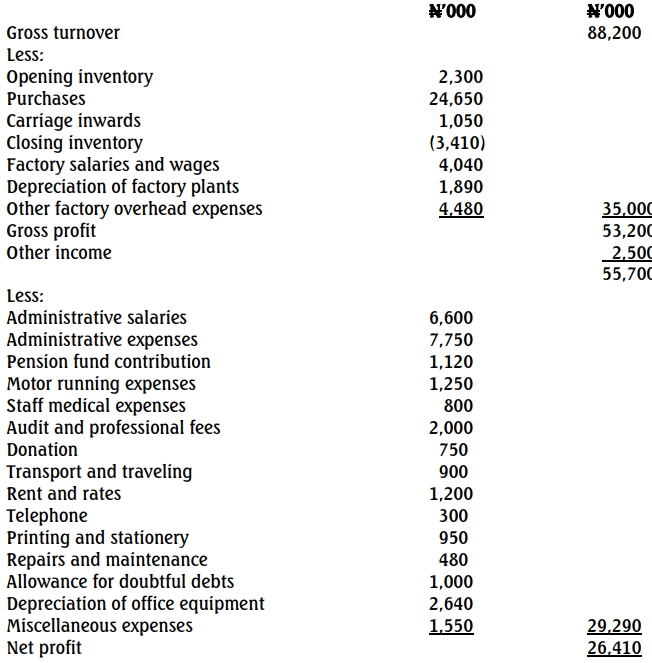

The statement of profit or loss for the year ended December 31, 2020, is as follows:

Additional Information:

- Other income included ₦320,000 realized from the disposal of an old plant.

- Administrative expenses included ₦250,000 paid to a legal practitioner for the defense and release of the company’s driver caught by traffic officers.

- 30% of motor running expenses was expended on the personal expenses of the Managing Director.

- 20% of the donation was paid to a State Government fund assisting insurgent victims.

- Repairs and maintenance included ₦215,000 for erecting a gate destroyed during a youth protest.

- Allowance for doubtful debts comprised ₦600,000 in general provision and ₦400,000 in specific provision.

- Miscellaneous expenses included ₦450,000 for hamper gifts to customers during Sallah and Christmas.

- A review revealed the gross turnover was understated by ₦750,000.

- The following is the schedule of qualifying capital expenditure on property, plant, and equipment:

| Nature |

Date of Acquisition |

Amount (₦’000) |

| Factory building |

September 8, 2016 |

3,800 |

| Furniture & fittings |

October 12, 2016 |

1,600 |

| Motor van |

June 19, 2018 |

4,200 |

| Factory building |

March 8, 2020 |

6,500 |

| Furniture & fittings |

April 15, 2020 |

2,000 |

| Industrial plant |

July 1, 2020 |

5,700 |

| Motor van |

December 20, 2020 |

4,240 |

- Unutilized capital allowances brought forward was ₦1,500,000, with a balancing charge of ₦155,000 on disposal of the old plant.

Required:

As the company’s tax consultant, prepare a report to the Group Managing Director covering the following:

a. Provisions of the Companies Income Tax Act CAP C21 LFN 2004 (as amended) and Finance Act 2020 regarding maintenance of books or records of accounts (4 Marks)

b. Back duty audit and its implications (4 Marks)

c. Computation of the company’s tax liabilities (with supporting schedules) for the relevant tax year (22 Marks)