- 10 Marks

FR – Nov 2024 – L2 – Q4b – Financial Performance Assessment of Acquisition Targets

Assessment of financial performance and position of Suah LTD and Nagbe LTD to assist Dukuly LTD in an acquisition decision.

Question

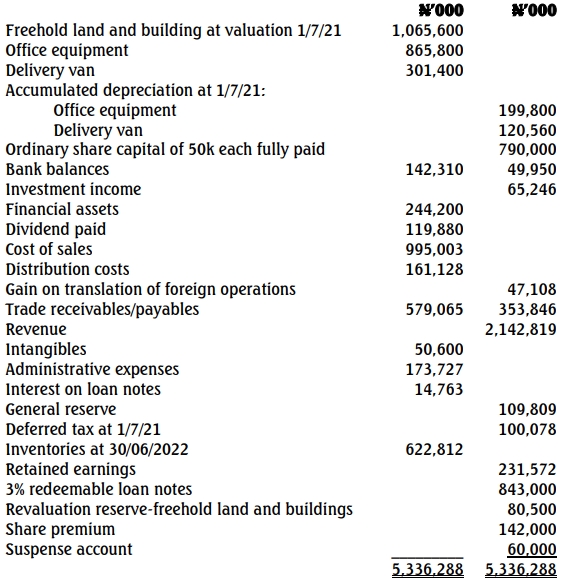

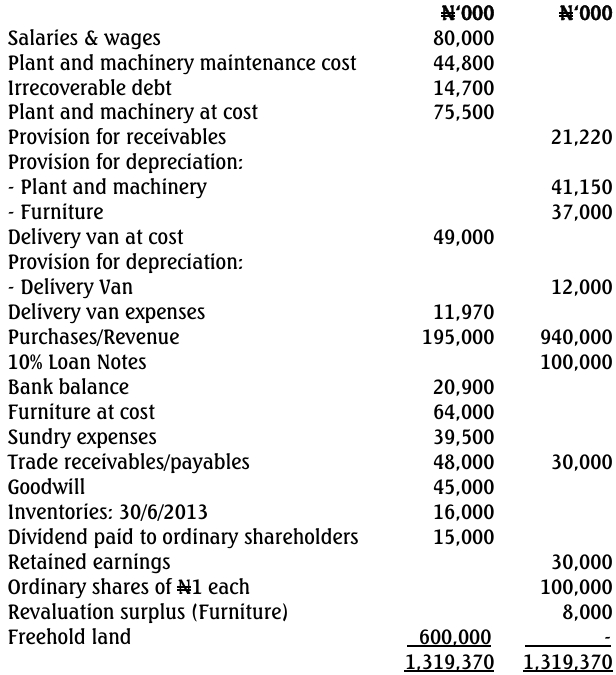

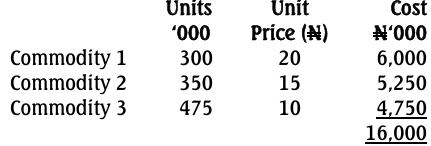

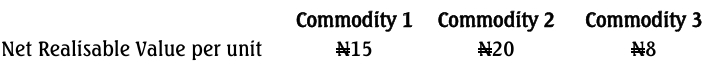

Dukuly LTD, a public entity, has been expanding through acquisitions. It is assessing two potential acquisition targets, Suah LTD and Nagbe LTD, both operating in the same industry.

The financial statements of Suah LTD and Nagbe LTD for the year ended 30 September 2024 have been provided, along with a set of financial ratios calculated for Suah LTD.

Required:

Using the calculated ratios for Nagbe LTD from Question 4a, assess the relative financial performance and financial position of Suah LTD and Nagbe LTD, to assist the directors of Dukuly LTD in making an acquisition decision.

Find Related Questions by Tags, levels, etc.

Report an error