- 10 Marks

CR – July 2023 – L3 – Q3a – IAS 36: Impairment of assets

Apply IAS 36 to determine impairment of a cash-generating unit, including goodwill allocation and fair value considerations.

Question

a) Sandoo Ltd is a company which manufactures machinery for industrial use and has a year end of 31 December 2021. The directors of Sandoo Ltd require advice on the following transaction:

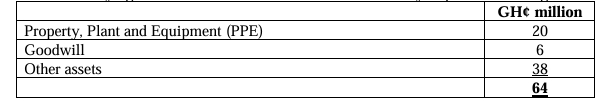

i) Sandoo Ltd acquired a cash-generating unit (CGU) several years ago but, at 31 December 2021, the directors of Sandoo Ltd were concerned that the value of the CGU had declined because of a reduction in sales due to new competitors entering the market. At 31 December 2021, the carrying amounts of the assets in the CGU before any impairment testing were:

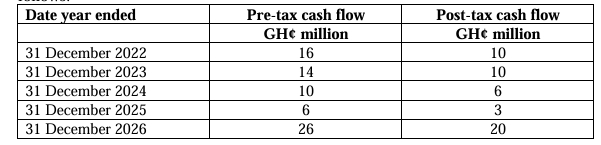

ii) The fair values of the Property, Plant and Equipment and the other assets at 31 December 2021 were GH¢20 million and GH¢34 million respectively and their costs to sell were GH¢200,000 and GH¢600,000 respectively. The CGU’s cash flow forecasts for the next five years are as follows:

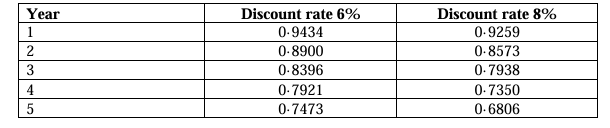

iii) The pre-tax discount rate for the CGU is 8% and the post-tax discount rate is 6%. Sandoo Ltd has no plans to expand the capacity of the CGU and believes that a reorganisation would bring cost savings but, no plan has been approved. The directors of Sandoo Ltd need advice as to whether the CGU’s value is impaired. The following extract from a table of present value factors has been detailed below:

Required: With reference to relevant International Financial Reporting Standards: Advise the directors of Sandoo Ltd on how the above transactions should be accounted for in its financial statements as at 31 December 2021.

(10 marks)

Find Related Questions by Tags, levels, etc.