- 8 Marks

AT – Dec 2023 – L3 – Q2a – Tax Planning

Computation of tax implications under thin capitalization rules and definition of exempt persons in corporate taxation.

Question

Scenario:

Papana Ltd, a resident company in Ghana, has cash flow challenges after a major customer ceased business dealings. Dawadawa Ltd, another resident company, negotiated with Papana Ltd and acquired 52% of its underlying ownership. As part of this arrangement, Dawadawa Ltd secured a loan facility of GH¢100 million for Papana Ltd at an interest rate of 4% above the average rate of 25%. The total interest paid in 2021 was GH¢2 million. Dawadawa Ltd is exempt from tax on all its income.

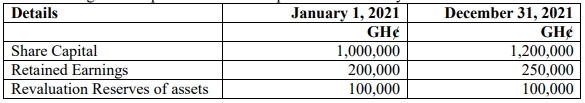

The capital structure of Papana Ltd for the 2021 year of assessment is as follows:

Required:

i) Compute the tax implications of the above arrangement.

ii) What constitutes an exempt person?

Find Related Questions by Tags, levels, etc.

- Tags: Corporate Tax, Exempt persons, Interest Deduction, Thin Capitalization

- Level: Level 3

- Topic: Tax planning

- Series: DEC 2023

Report an error