- 15 Marks

CR – Mar 2024 – Q4a – Business valuation

Apply various valuation methods to determine the value of Meddy Ltd's shares in a potential merger scenario with Flossybeats Ltd.

Question

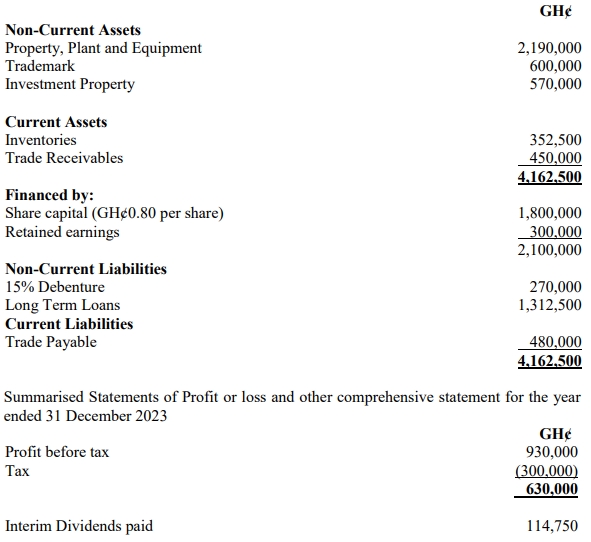

Flossybeats Ltd is a major competitor of Meddy Ltd in the telecommunication industry. Flossybeats Ltd is listed on the Ghana Stock Exchange with a P/E ratio of 11 and a dividend yield of 7.2%. Directors of Flossybeats Ltd have been presented with a proposal to merge with Meddy Ltd which owns 45% of the market share but not yet listed. The summarized financial statements of Meddy Ltd for the year 2023 are given below:

Statement of Financial Position as at 31 December 2023

Additional information: i) An existing property included in property, plant and equipment with a carrying value of GH¢675,000 could be developed as a site for residential use at a cost of GH¢75,000 and would then be worth GH¢975,000. The remaining property, plant and equipment can be used to generate a net cashflow of GH¢300,000 each year for the foreseeable future.

ii) The worth of the Investment Property is difficult to value, as there is no active market. A normal sale in the present condition could be reasonably expected to yield GH¢600,000 based on an analysis of transactions in similar assets.

iii) The trademark represents a license to produce and sell a special product which is expected to generate an after-tax profit of GH¢1,500,000 over the next four years. The expected after-tax profit projection was made without the consideration of amortisation of the book value of the trademark over the same period.

iv) The discounted present value of future cash payments in respect of long-term loan is GH¢975,000. The discount rate of Meddy Ltd is 25% per annum but the financial controller asserts that beta of the company is 1.5. The Treasury bill rate and the return on the market are estimated to be 16% and 23% respectively.

v) Dividend payments of Meddy Ltd in 2022 was GH¢112,500. The dividend growth achieved in 2023 is expected to be sustained in the foreseeable future.

Required: Advise the directors of Meddy Ltd on the value to be placed on the ordinary shares using:

- Net Assets Method

- Constant Dividend Method

- Dividend Growth Method

- Earning based (P/E) Method

Find Related Questions by Tags, levels, etc.

- Tags: Asset-Based Method, Dividend Method, Earning Method, Gordon's Growth Model, Valuation

- Level: Level 3

- Topic: Business valuations

- Series: MAR 2024