- 20 Marks

FR – Nov 2020 – L2 – Q6 – Property, Plant, and Equipment (IAS 16)

Discuss depreciation concepts and characteristics under IAS 16 and calculate machine cost, revenue expenditures, and carrying amounts over the years.

Question

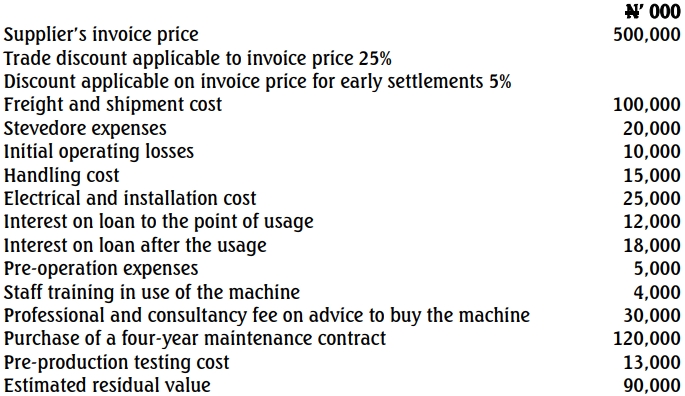

Noodles Nigeria Limited (NNL) manufactures various types of noodles in Oluyole for sale across Nigeria. Recently, to sustain the company’s market leadership, NNL bought a brand new machine under the following conditions:

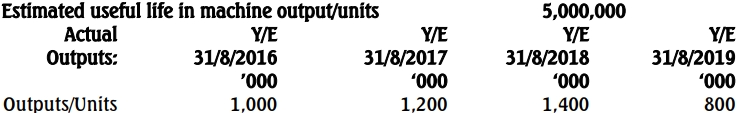

On September 1, 2016, NNL decided to upgrade the machine by adding new major components at a cost of N300,000,000. As a result of the upgrade, the remaining useful life was increased to 8,000,000 units and the residual value was revised to N114,000,000.

Required:

a. Describe what is meant by depreciable amount within the context of IAS 16 on property, plant, and equipment (PPE). (1 Mark)

b. Highlight THREE characteristics of depreciable assets under IAS 16. (3 Marks)

c. Describe the TWO models of accounting for cost of PPE under IAS 16. (3 Marks)

d. Calculate the following:

i. Machine cost. (3 Marks)

ii. Revenue expenditure over the years in the statement of profit or loss. (5 Marks)

iii. Carrying amounts of the machine over the years. (5 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Accounting Models, Depreciable Amount, Depreciable assets, IAS 16

- Level: Level 2

- Topic: Property, Plant, and Equipment (IAS 16)

- Series: NOV 2020