- 6 Marks

PT – Dec 2023 – L2 – Q4b – Corporate Tax Liabilities

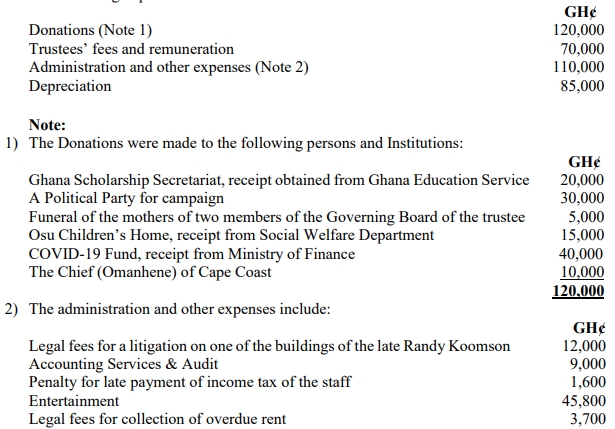

Explanation of the tax treatment for research and development expenses under tax law.

Find Related Questions by Tags, levels, etc.

- Tags: Corporate Tax, Deductible expenses, Research and Development, Tax law

- Level: Level 2

- Topic: Corporate Tax Liabilities

- Series: DEC 2023

Report an error