- 20 Marks

PSAF – May 2022 – L2 – SA – Q4 – Government Revenue

Compute financial ratios for Koki Event Center and highlight ways to conduct analytical reviews.

Question

The following information relates to Koki Event Center which is owned and managed by Ogbonge Local Government.

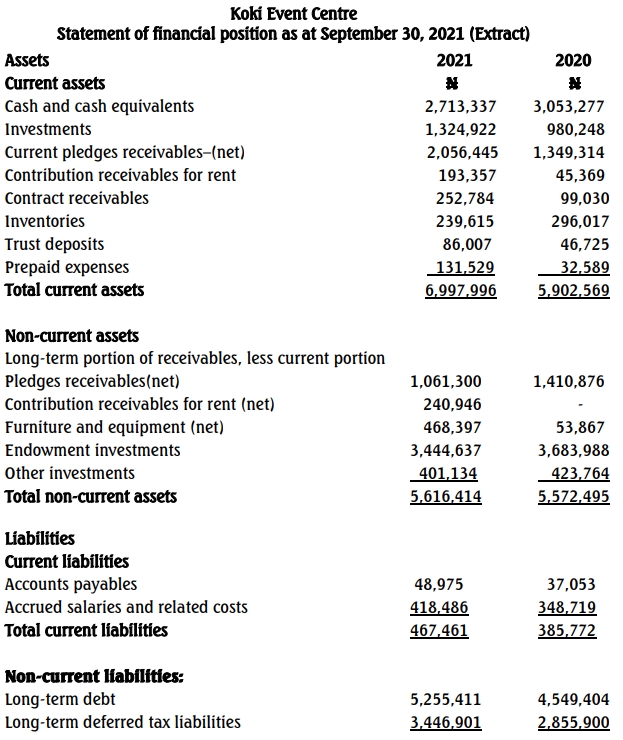

Koki Event Centre

Statement of financial position as at September 30, 2021 (Extract)

Required:

a. Compute the following relevant ratios for the event centre and comment on your results:

i. Current ratio (3 Marks)

ii. Acid test ratio (3 Marks)

iii. Working capital/Total assets ratio (3 Marks)

iv. Total debts/Total assets ratio (3 Marks)

v. Long-term debts/Total assets ratio (3 Marks)

b. Highlight THREE ways by which analytical review can be conducted. (3 Marks)

c. Explain TWO ways the performance appraisal of a profit-oriented entity would differ from that of a public-oriented entity. (2 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Analytical review, Current Assets, Event Center, Financial Ratios, Long-Term Debts, Public Sector

- Level: Level 2

- Topic: Government Revenue

- Series: MAY 2022