- 10 Marks

MA – July 2023 – L2 – Q3b – Cash budgets and master budgets

Prepare a monthly cash budget for the first quarter of 2023 for GoGo Ltd, including debtors collection and creditors payment schedules.

Question

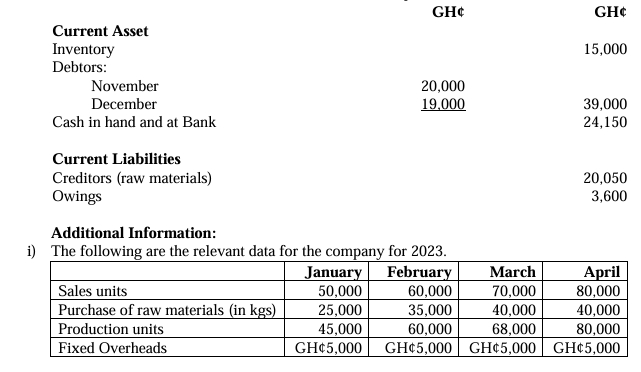

b) An extract from the accounts of GoGo Ltd for the last quarter of 2022 is as follows:

The selling price for the products is expected to be GH¢2.5 for the first quarter of 2023. Generally, 60% of sales is collected in the month of sale while 35% is collected in the following month, with the remaining debts declared as bad thereon. The company introduced a debt recovery strategy in the third quarter of 2022 which yielded a collection of 75% of outstanding debts in the first month after being declared as bad debt.

ii) One kilogramme of the raw material can be used to produce two products. A kilogramme of the raw material cost GH¢1.30. Due to an anticipated shortage in raw materials, the company plans to pay for all purchases of raw materials, one month ahead of time.

iii) Wages and variable production overheads are charged at GH¢0.50 and GH¢0.25 respectively per unit produced. Wages and all overheads are paid in the month in which they are incurred. Included in fixed overheads is a monthly depreciation of GH¢750. All other owings are due for payment in the month of January.

Required: Prepare the monthly cash budget for the first quarter of 2023, showing the sub-totals.

Find Related Questions by Tags, levels, etc.

- Tags: Cash Budget, Cash Flow, Creditors Payment, Debtors Collection, Working Capital

- Level: Level 2

- Topic: Cash Budgets and Master Budgets

- Series: JULY 2023