- 9 Marks

FR – Nov 2023 – L2 – Q4b – Financial Statement Analysis

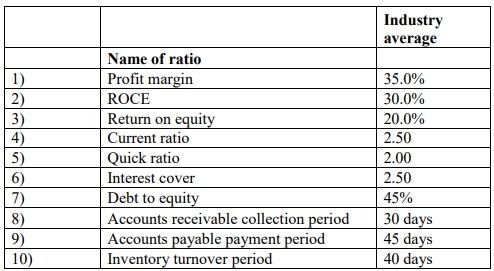

Write a report analyzing the performance of two companies, Addin Petroleum and Gyan Petroleum, using key financial ratios.

Find Related Questions by Tags, levels, etc.

- Tags: Acquisition, Comparative Analysis, Financial Performance, Financial Ratios, Gearing, Liquidity, Profitability

- Level: Level 2

- Topic: Financial Statement Analysis

- Series: NOV 2023

Report an error

Required:

Required: