- 13 Marks

CR – May 2018 – L3 – SB – Q3b – Impairment of Assets (IAS 36)

valuate discontinuation conditions and prepare profit or loss statement for Bamgbose Plc with comparative figures.

Question

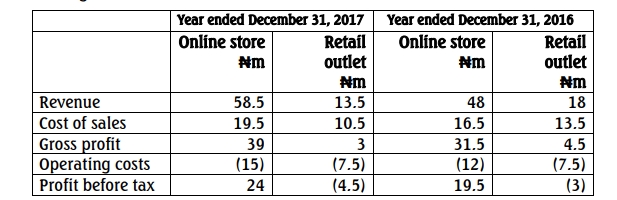

Bamgbose Plc. is a long-established travel agent, operating through a network of retail outlets and online store. In recent years, the business has seen its revenue from the online store grow strongly, and that of retail outlets decline significantly. On July 1, 2017, the board decided to close the retail network at the financial year end of December 31, 2017, and put the buildings up for sale on that date. The directors are seeking advice regarding the treatment of the buildings in the statement of financial position as well as the treatment of the trading results of the retail division for the year. The following figures are available at December 31, 2017:

- Carrying amount of buildings: ₦30.0 million

- Fair value less costs to sell of buildings: ₦25.8 million

- Other expected costs of closure: ₦5.85 million

Required:

(i) Outline the conditions which must be met in order to present the results of an operation as “discontinued” and the accounting treatment that applies when such a classification is deemed appropriate. (5 Marks)

(ii) Draft the statement of profit or loss for Bamgbose Plc. for year ended December 31, 2017, together with the comparative figures for 2016, taking the above information into account. (8 Marks)

Find Related Questions by Tags, levels, etc.