- 15 Marks

AT – Nov 2024 – L3 – Q1a – Computation of Partnership Chargeable Income

Compute the partnership's chargeable income for the 2023 year of assessment.

Question

Takyi and Kuro commenced a retail business in Goaso, Ghana on 1 January 2020, under the partnership name Ntaafo LTD, sharing profits and losses equally. On 1 January 2023, Tawia was admitted as a new partner. Takyi, Kuro, and Tawia then shared profits and losses in the ratio of 3:2:1 respectively. The partnership prepares its accounts to 31 December annually.

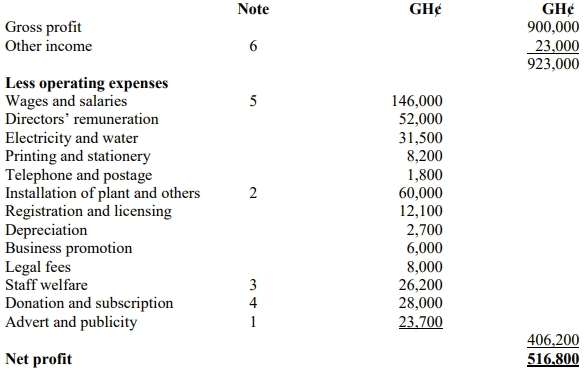

The partnership’s profit and loss account for the year ended 31 December 2023 is as follows:

| Note | GH¢ | GH¢ |

|---|---|---|

| Gross Trading Profit | 4,365,000 | |

| Compensation | (1) | 50,000 |

| Total Revenue | 4,415,000 | |

| Less: Operating Expenses | ||

| Audit Fees | 25,000 | |

| Rent and Rates | (2) | 348,000 |

| Wages and Salaries | (3) | 1,410,000 |

| Interest on Capital | (4) | 205,000 |

| Contribution towards National Insurance Scheme | 111,000 | |

| Trade Debts Written Off (Bad Debts) | 92,000 | |

| Legal Fees | (5) | 43,000 |

| Entertainment | (6) | 270,000 |

| Motor Expenses | (7) | 87,000 |

| Repairs and Maintenance | (8) | 190,000 |

| Commission | (9) | 310,000 |

| Printing and Stationery | 82,000 | |

| Electricity and Telephone | 51,000 | |

| Depreciation | 123,000 | |

| Sundry Expenses | 270,000 | |

| Total Expenses | 3,617,000 | |

| Net Profit | 798,000 |

Notes:

-

Compensation:

- Compensation received from suppliers for delays in supplies: GH¢70,000

- Court fines paid to client for negligence: (GH¢20,000)

-

Rent and Rates:

- Rent for business premises: GH¢180,000

- Rent for Takyi’s private residence: GH¢156,000 (Disallowed)

- Business operating permit paid to Goaso Municipal Assembly: GH¢12,000

-

Wages and Salaries:

- Takyi: GH¢180,000

- Kuro: GH¢240,000

- Tawia: GH¢66,000

- Mrs. Takyi (staff): GH¢120,000

- Mrs. Tawia (staff): GH¢144,000

- Other staff: GH¢660,000

-

Interest on Capital:

- Takyi: GH¢30,000

- Kuro: GH¢40,000

- Tawia: GH¢10,000

- Bank interest: GH¢125,000

-

Legal Fees:

- Renewal of annual tenancy agreements: GH¢8,000

- Collection of trade debts: GH¢10,000

- Preparing contract documents (suppliers and contractors): GH¢5,000

- Preparing contract documents to acquire a new company: GH¢20,000 (Disallowed)

-

Entertainment:

- The entertainment expenses relate to the partners’ private enjoyment (Disallowed).

-

Motor Car Expenses:

- Petrol: GH¢52,000

- Repairs: GH¢30,000

- Fines for late renewal of vehicle license: GH¢5,000 (Disallowed)

-

Repairs and Maintenance:

- Replacement of bolts and nuts on Plant and Machinery: GH¢10,000

- Major expenditure on Landscaping and Renovation: GH¢180,000 (Capitalized)

-

Commission:

- Takyi (for introducing a new customer to the business): GH¢20,000 (Disallowed)

- Salesmen and Saleswomen: GH¢230,000

- Unidentified recipient: GH¢60,000 (Disallowed)

Other Information:

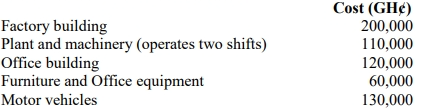

- Capital allowance agreed with the Ghana Revenue Authority (GRA) was GH¢234,000 for the 2023 year of assessment.

Required:

Compute the partnership’s chargeable income for the 2023 year of assessment.

Find Related Questions by Tags, levels, etc.