- 6 Marks

CR – May 2017 – L3 – Q7b – Integrated Reporting

Discuss the usefulness of cash flow statements and the potential benefits of integrated reporting.

Question

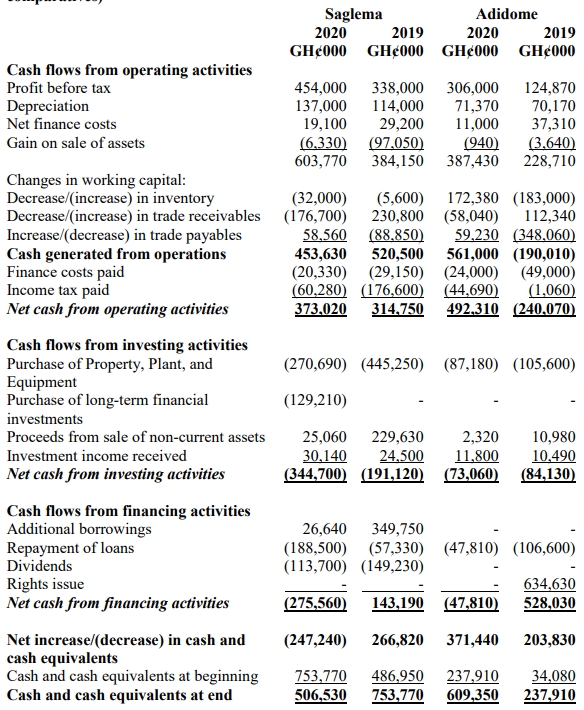

The directors of Duranga Plc. have learned that corporate reporting could be improved by adopting the International Integrated Reporting Council’s Framework for Integrated Reporting. The directors believe that International Financial Reporting Standards (IFRS), which the company has recently adopted following the decision of the Federal Executive Council, are already extensive and provide stakeholders with a comprehensive understanding of its financial position and performance for the year. They believe that with over 100 countries adopting IFRS, their financial statements speak the international financial reporting language and practice. In particular, statements of cash flows, which the company prepares in accordance with IAS 7, enable stakeholders to assess the liquidity, solvency, and financial adaptability of a business. They are concerned that any additional disclosures could be excessive and obscure the most useful information within a set of financial statements. This is against the backdrop of a recent effort by the IASB on excessive disclosures in financial statements. They are therefore unsure of the rationale for the implementation of a separate or combined integrated report.

Required:

Discuss the extent to which statements of cash flow provide stakeholders with useful information about an entity and whether this information would be improved by the entity introducing an Integrated Report. (6 Marks)

Find Related Questions by Tags, levels, etc.