- 11 Marks

FR – Nov 2018 – L2 – SC – Q6a and Q6b – Property, Plant, and Equipment (IAS 16)

Calculate costs of various intangible assets and their carrying amounts as at December 31, 2017.

Question

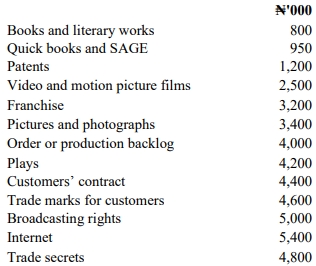

Intangibles assets by their nature do not exist physically under IAS 38 Intangible assets. The

following information on initial cost of intangibles asset were extracted from the Notes to the

financial statements of Igbo-hood Limited, a film production company on January 1, 2017:

Additional Information:

(i)

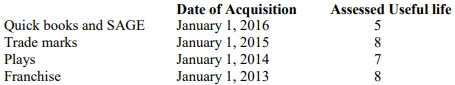

(ii) Intangible assets are to be amortised on a straight line basis.

Required:

a. Calculate the costs of the following intangible assets:

i. Market based

ii. Customer related

i. Artistic related

iv. Contract based

v. Technology based

b. Calculate the carrying amounts of the following intangibles assets as at December 31, 2017

i. Quick books and SAGE

ii. Trade marks

iii. Plays

iv. Franchise

Find Related Questions by Tags, levels, etc.

- Tags: Amortization, Carrying Amount, Customer-Related, Intangible Assets, Market-Based, Technology-Based

- Level: Level 2

- Topic: Property, Plant, and Equipment (IAS 16)

- Series: NOV 2018

Report an error