- 20 Marks

AT – April 2022 – L3 – Q4 – Capital allowance | Business income – Corporate income tax

Calculate capital allowance and chargeable income for Joefel Company Ltd. Explain sources of revenue from upstream petroleum operations in Ghana.

Question

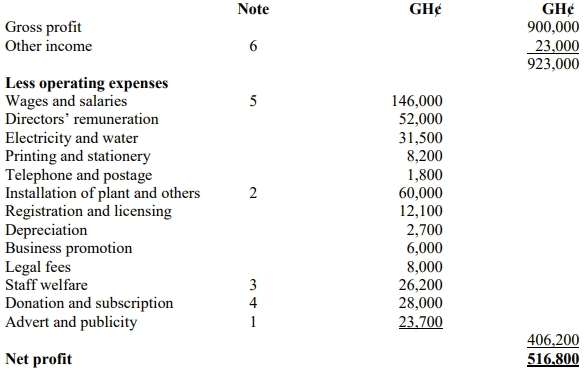

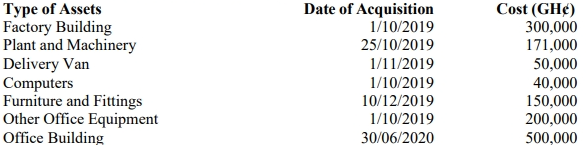

a) Joefel Company Ltd, manufacturer of fruit juice for local consumption commenced business on 1 October 2019, with accounting year-end at 31 December each year. The company submitted its accounts for 2019 and was assessed accordingly. The company submitted its tax returns for 2020 year of assessment to the Ghana Revenue Authority on 30 April 2021. Below are the details:

Additional information:

1) Advert and publicity

Radio and television 3,300

Newspaper advert 2,400

Permanent signboard at the company’s entrance in 2020 18,000

2) Installation of plant and others

Installation of plant 21,500

Heavy duty Generator bought in 2019 to support Plant and Machinery 20,500

General maintenance before the use of the plant 18,000

3) Staff Welfare

Staff medical bills 3,700

Safety wear for staff 10,500

Canteen Equipment purchased on 30 November 2020 12,000

4) Donation and Subscription

Goods given as gratis to customs officials 13,000

Donation of goods to SOS Children Village 10,000

Subscription to Association of Ghana Industries 5,000

5) Wages and Salaries

Old staff 120,000

Fresh graduates employed by Joefel Company Ltd. (Fresh graduates

constitute 1% of total workforce) 26,000

6) Other Income

Compensation from a customer for cancellation of a sale order 8,000

Compensation for loss of trading stock of the company 10,000

Compensation for cancellation of purchase order by supplier 5,000

Note 2) above has not been included in the plant and machinery acquired.

Required:

a

i) Compute the appropriate capital allowance for 2019 and 2020 years of assessment.

(8 marks)

ii) Calculate the chargeable income of the company for the 2020 year of assessment.

(6 marks)

b) Explain of the following sources of revenue accruing to the Government of Ghana from the upstream petroleum operations in Ghana:

i) Royalty.

ii) Carried Interest.

iii) Additional Interest.

iv) Additional Oil Entitlement.

(6 marks)

Find Related Questions by Tags, levels, etc.