- 20 Marks

PSAF – March 2024 – L2 – Q2 – Preparation of Financial Statements for Central Government

Prepare the Statement of Financial Performance, Statement of Financial Position, and Statement of Budget Information for a central government department based on the given trial balance.

Question

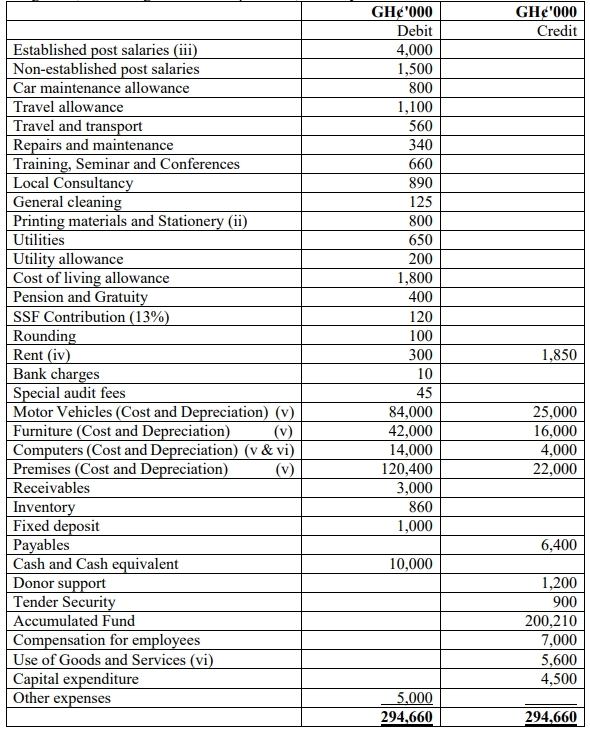

The following Trial Balance was extracted from the records of the Department of Social Integration, a central government department, for the year ended 31 December 2023.

Additional Information:

- The Department prepares its financial statements in compliance with the International Public Sector Accounting Standards, the Public Financial Management Act 2016, Act 921, and the Chart of Accounts of the Government of Ghana.

- Included in printing materials and stationery is a closing inventory valued at cost of GH¢380,000. The estimated net realizable value and replacement cost of the inventory are GH¢320,000 and GH¢330,000 respectively. The printing is not for commercial purposes.

- In June 2023, the government conducted a massive recruitment into the civil services, of which 20 employees were posted to the Department. However, they have not been paid salaries for the period. The amount owed to these employees is GH¢2,500,000 and this should be reflected in the financial statement of the period.

- The Department currently pays rent for two of its Regional Offices, and at the end of the year rent of GH¢200,000 was outstanding. Further, the Department also rented part of its premises at the Headquarters. At the end of the financial year, an amount of GH¢150,000 was received to cover 2024 rent. Meanwhile, GH¢20,000 rent has not been received from tenants for the year 2023. These transactions have not been accounted for.

- Depreciation of fixed assets is charged on a straight-line basis as follows:

| Assets | Estimated useful life (in years) |

|---|---|

| Motor vehicle | 5 years |

| Furniture | 4 years |

| Computers | 3 years |

| Premises | 20 years |

- It was revealed that computer accessories costing GH¢340,000 acquired in 2022 were accounted for as goods and services. However, the Auditor for the 2023 financial year recommended that the transaction should be accounted for as a non-current asset. The recommendation is yet to be implemented.

- The budget extract of the Department for 2023 is as follows:

| Item | GH¢’000 |

|---|---|

| Approved budget allocation | 20,000 |

| Internally generated fund | 3,000 |

| Donor support | 1,000 |

| Compensation for employees | 10,000 |

| Use of Goods and Services | 6,000 |

| Other expenses | 5,500 |

Required: Prepare in compliance with the International Public Sector Accounting Standards, the Public Financial Management Act 2016, and the Chart of Accounts of Ghana: a) A Statement of Financial Performance for the year ended 31 December 2023.

b) A Statement of Financial Position as at 31 December 2023.

c) A Separate Statement of Budget Information in comparison with the Actuals for the year ended 31 December 2023.

Find Related Questions by Tags, levels, etc.

Report an error