- 20 Marks

MA – Nov 2021 – L2 – Q5 – Cost-Volume-Profit (CVP) Analysis

Calculate breakeven point, profit under full capacity, and analyze profitability options for Claudia Footwear.

Question

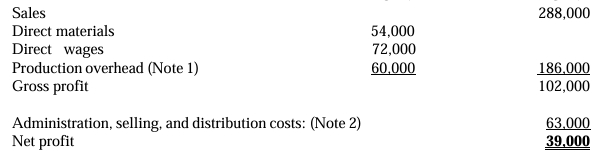

a) Claudia Footwear (CFW) has developed a new range of high-quality affordable sandals for beachwear. The sandals are based on an innovative design that protects feet from the effects of sun, salt, and sand. The company has already received some sales orders for 9,000 sandals which form 75% of the operating capacity of CFW, and production is due to commence next month. The Management Accountant has prepared the following projections based on 75% operating capacity for the trading year ahead:

Notes:

- Production overhead is made up of fixed and variable costs in the proportion of 7:3, respectively.

- GH¢36,000 of the total administration, selling, and distribution costs is fixed, and the remainder varies with sales volume.

Required:

i) Calculate the breakeven point in units and value. (4 marks)

ii) Calculate the profit that could be expected if the company operated at full capacity. (3 marks)

b) In order to enhance profitability, CFW has proposed the following options:

Option one:

If the selling price per unit were reduced by GH¢4, the increase in demand would utilize 90% of the company’s capacity without any additional advertising expenditure.

Option two:

To attract sufficient demand to utilize full capacity would require a 15% reduction in the current selling price. In addition, however, CFW would have to spend GH¢5,000 on a special advertising campaign.

Option three:

To attract sufficient demand to utilize full operating capacity without changing the selling price per unit, CFW has to spend GH¢35,000 on a special advertising campaign.

Required:

Present a statement showing the effect of the three alternatives compared with the original budget and advise management of CFW which of the FOUR possible plans ought to be adopted (the original budget plan or any of the three options). (10 marks)

c) State TWO (2) limitations and ONE (1) usefulness of Cost-Volume-Profit analysis. (3 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Breakeven Point, CVP Analysis, Decision Making, Profitability, Scenario Analysis

- Level: Level 2

- Topic: Cost-Volume-Profit (CVP) Analysis

- Series: NOV 2021