- 15 Marks

FA – May 2013 – L1 – SB – Q6 – Accounting Concepts

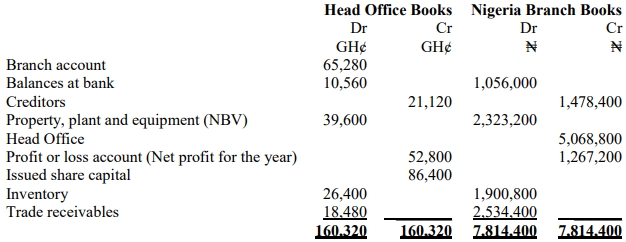

This question involves preparing the current accounts, cash-in-transit and inventories-in-transit accounts, and an aggregate Statement of Financial Position for October Enterprises Limited.

Question

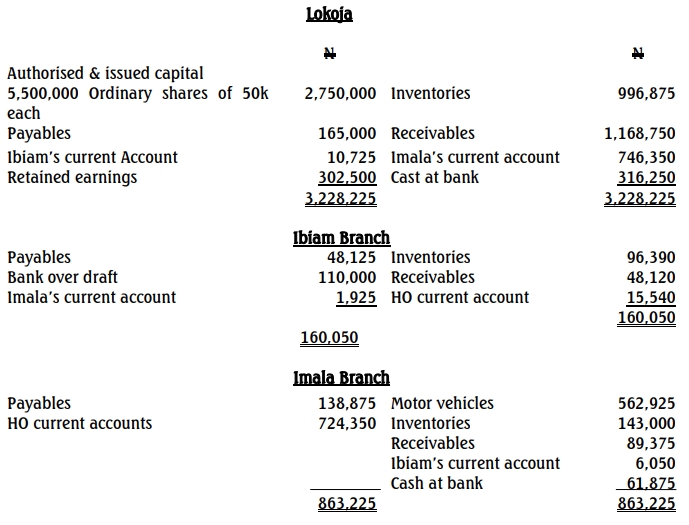

October Enterprises Limited has its Head office in Lokoja with branches in Ibiam and Imala. The following are the separate Statements of Financial Position of the Head Office (HO) and branches as at 31 December 2012:

Additional Information:

i. Ibiam’s current account balance with HO was arrived at after debiting ₦2,750 cash remitted to Ibiam on 31 December, which was received on 1 January the following year.

ii. Imala’s current account balance with HO was arrived at after debiting ₦8,250 value of inventories returned to Imala on 31 December, which was received in Imala on 1 January the following year.

iii. HO current account balance with Ibiam was arrived at after debiting ₦2,065 inventories returned to HO on 31 December and received in Lokoja on 5 January the following year.

iv. Imala’s current account with Ibiam was arrived at after debiting ₦4,125 inventories sent to Imala on 31 December and received in Imala on 10 January the following year.

v. HO current account with Imala was arrived at after debiting ₦13,750 cash sent to Lokoja on 31 December and received in Lokoja on 12 January the following year.

You are required to prepare:

a. Current accounts (6 Marks)

b. Cash-in-transit account (1 Mark)

c. Inventories-in-transit account (3 Marks)

d. Aggregate Statement of Financial Position as at 31 December 2012, after incorporating the above transactions. (5 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Branch accounts, Cash-in-Transit, Consolidation, Current Accounts, Inventories-in-Transit

- Level: Level 1

- Topic: Accounting Concepts

- Series: MAY 2013