- 1 Marks

FA – Nov 2012 – L1 – SA – Q26 – Recording Financial Transactions

Identifying an alternative source for computing credit sales in the absence of a sales day book.

Find Related Questions by Tags, levels, etc.

Report an error

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

a) The transactions below relate to Affram Ltd for the year ended 30 April 2022:

1 May 2021 balance b/d:

| Account | GHȼ |

|---|---|

| Sales Ledger Control Account | 180,000 Dr |

Totals for the year 1 May 2021 to 30 April 2022:

| Item | Amount (GHȼ) |

|---|---|

| Credit sales | 600,500 |

| Receipts from customers | 690,100 |

| Discount allowed | 12,000 |

| Irrecoverable debts | 5,400 |

| Sales returns | 4,600 |

| Dishonoured cheques from customers | 3,000 |

| Contras between sales and purchases | 14,000 |

The Sales Ledger Control Account balance failed to agree with the total receivables of GHȼ67,800 as shown by the Schedule of Receivables.

The following errors were subsequently discovered:

Required:

i) Prepare the Receivables Control Account for the year ended 30 April 2022. (8 marks)

ii) Prepare a statement reconciling the corrected balance on the Receivables Control Account with the corrected balance on the Schedule of Receivables. (3 marks)

b) Book-keeping is the process of recording financial transactions in the accounting records (the books) of an entity. Transactions are initially recorded in books of prime entry also known as books of original entry.

Required:

Identify SIX (6) books of prime entry and their functions. (9 marks)

Find Related Questions by Tags, levels, etc.

(a)

i. Define Book of Prime Entry. (1 mark)

ii. Mention any four (4) Books of Prime Entry. (4 marks)

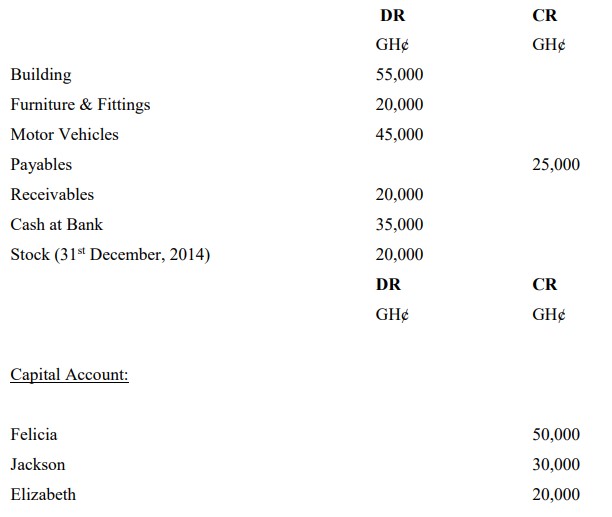

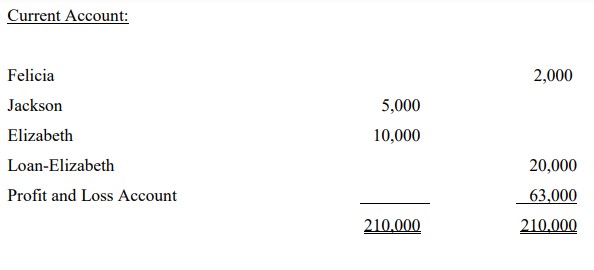

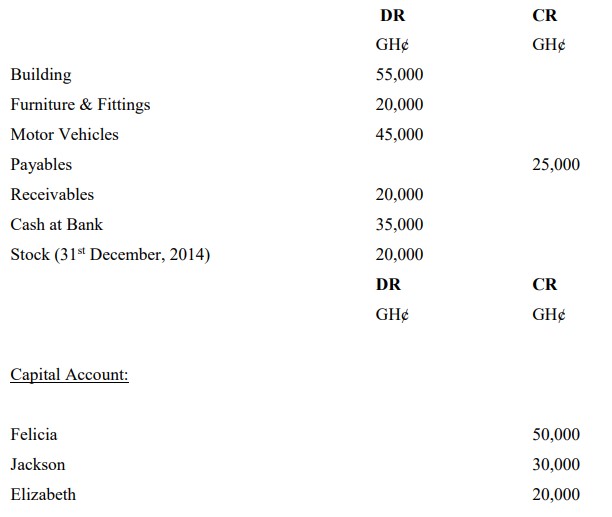

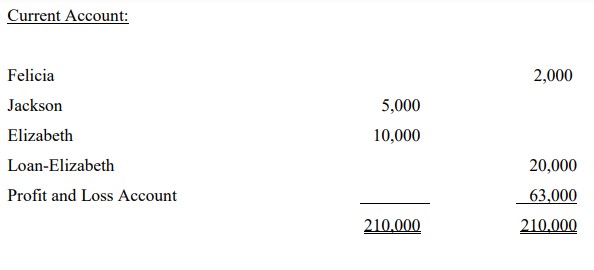

(b) Felicia, Jackson, and Elizabeth are in Partnership Sharing Profits and Losses in the ratio of 5:3:2 respectively. According to the Partnership Agreement, Partners’ Capital Accounts attract an interest of 20% per annum, while any Drawings by a Partner also attract 10% interest per annum.

The following understated Trial Balance has been extracted after the preparation of the Profit and Loss Account for the period ending 31st December 2014:

The following entries have not been recorded in the books:

i. Salary of GH¢5,000 was paid to Elizabeth during the period.

ii. Felicia personally paid General Expenses of GH¢2,500 on behalf of the Partnership.

iii. Cash Drawings made by partners: Felicia GH¢500, Jackson GH¢1,500, and Elizabeth GH¢1,200.

iv. Interest on loan – Elizabeth – GH¢2,000.

v. Jackson took goods worth GH¢2,000 for personal use.

vi. Interest on Capital Account. All Capital Accounts were to remain fixed.

You are required to prepare:

i. Profit or Loss and Appropriation Account. (7 marks)

ii. Partners’ Current Account. (3 marks)

iii. Statement of Financial Position as at 31st December, 2014 (5 marks)

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

a) The transactions below relate to Affram Ltd for the year ended 30 April 2022:

1 May 2021 balance b/d:

| Account | GHȼ |

|---|---|

| Sales Ledger Control Account | 180,000 Dr |

Totals for the year 1 May 2021 to 30 April 2022:

| Item | Amount (GHȼ) |

|---|---|

| Credit sales | 600,500 |

| Receipts from customers | 690,100 |

| Discount allowed | 12,000 |

| Irrecoverable debts | 5,400 |

| Sales returns | 4,600 |

| Dishonoured cheques from customers | 3,000 |

| Contras between sales and purchases | 14,000 |

The Sales Ledger Control Account balance failed to agree with the total receivables of GHȼ67,800 as shown by the Schedule of Receivables.

The following errors were subsequently discovered:

Required:

i) Prepare the Receivables Control Account for the year ended 30 April 2022. (8 marks)

ii) Prepare a statement reconciling the corrected balance on the Receivables Control Account with the corrected balance on the Schedule of Receivables. (3 marks)

b) Book-keeping is the process of recording financial transactions in the accounting records (the books) of an entity. Transactions are initially recorded in books of prime entry also known as books of original entry.

Required:

Identify SIX (6) books of prime entry and their functions. (9 marks)

Find Related Questions by Tags, levels, etc.

(a)

i. Define Book of Prime Entry. (1 mark)

ii. Mention any four (4) Books of Prime Entry. (4 marks)

(b) Felicia, Jackson, and Elizabeth are in Partnership Sharing Profits and Losses in the ratio of 5:3:2 respectively. According to the Partnership Agreement, Partners’ Capital Accounts attract an interest of 20% per annum, while any Drawings by a Partner also attract 10% interest per annum.

The following understated Trial Balance has been extracted after the preparation of the Profit and Loss Account for the period ending 31st December 2014:

The following entries have not been recorded in the books:

i. Salary of GH¢5,000 was paid to Elizabeth during the period.

ii. Felicia personally paid General Expenses of GH¢2,500 on behalf of the Partnership.

iii. Cash Drawings made by partners: Felicia GH¢500, Jackson GH¢1,500, and Elizabeth GH¢1,200.

iv. Interest on loan – Elizabeth – GH¢2,000.

v. Jackson took goods worth GH¢2,000 for personal use.

vi. Interest on Capital Account. All Capital Accounts were to remain fixed.

You are required to prepare:

i. Profit or Loss and Appropriation Account. (7 marks)

ii. Partners’ Current Account. (3 marks)

iii. Statement of Financial Position as at 31st December, 2014 (5 marks)

Find Related Questions by Tags, levels, etc.

Elevate your professional expertise across key business domains with our comprehensive training programs

Follow us on our social media and get daily updates.

This feature is only available in selected plans.

Click on the login button below to login if you’re already subscribed to a plan or click on the upgrade button below to upgrade your current plan.

If you’re not subscribed to a plan, click on the button below to choose a plan