- 20 Marks

FA – May 2016 – L1 – Q6 – Preparation of not-for-profit accounts

Prepare the Bar Trading Account, Income and Expenditure Account, and Statement of Financial Position for ABSU Social Club.

Question

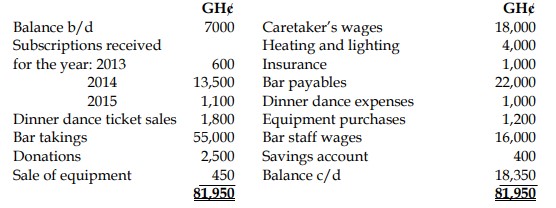

The ABSU Social Club prepares its accounts annually on 31st December. The Receipts and Payments Account for the year ended 31st December 2014 was prepared by the Treasurer as follows:

Receipts and Payments Account for the year ended 31st December 2014

Additional information:

i) The equipment sold during the year was valued in the books at GH¢600 on 1st January 2014. The Club’s policy is to provide a full year’s depreciation in the year of purchase but none in the year of sale.

ii) The savings account (short term) pays a fixed rate of interest of 5% per annum. An additional amount of GH¢400 was paid into the account on 1st July 2014. There were no withdrawals made during the year. Interest due on 31st December 2014 has not been received.

iii) The remaining assets and liabilities of the Club at the beginning and end of the year were:

| Description | 1st January 2014 | 31st December 2014 |

|---|---|---|

| Clubhouse | GH¢230,000 | GH¢230,000 |

| Equipment | GH¢26,000 | GH¢25,200 |

| Savings account (short term) | GH¢2,000 | GH¢2,400 |

| Insurance prepaid | GH¢100 | GH¢80 |

| Bar staff wages owing | GH¢180 | GH¢160 |

| Subscriptions due and unpaid | GH¢800 | GH¢300 |

| Subscriptions paid in advance | GH¢700 | GH¢1,000 |

| Bar payables | GH¢2,400 | GH¢1,400 |

| Bar inventory | GH¢7,500 | GH¢8,700 |

iv) All subscriptions due for the year 2013, but unpaid on 31st December 2014 are considered to be irrecoverable debts.

v) Bar staff wages are the only expense to be charged to the Bar Trading Account.

Required:

a) Prepare the Bar Trading Account for the year ended 31st December 2014. (5 marks)

b) Prepare the Income and Expenditure Account for the year ended 31st December 2014. (8 marks)

c) Prepare the Statement of Financial Position as at 31st December 2014. (7 marks)

Find Related Questions by Tags, levels, etc.