- 20 Marks

AT – NOV 2021 – L3 – Q3 – Business income – Corporate income tax | Capital allowances

Compute taxable income and tax payable for Partey Ltd after business restructuring involving transfer of assets to employees and disposal of assets.

Question

Partey Ltd (Partey) produces flour and various soup powders, and the company is considered as a priority company. On 1 January 2019, Partey owned two refineries in Accra (Weija and Mamprobi) and a refinery in Takoradi. Each refinery comprises building, plant and equipment and a warehouse, all of which were owned by Partey.

Partey has been having financial difficulties and, on 1 February 2019, engaged the services of a business consultant to recommend a survival plan for the company. Unfortunately, staff morale was very low when the business consultant was engaged because their salaries were six months in arrears.

The business consultant’s recommendations were agreed and implemented in the year ended 31 December 2019 as follows:

i) The Takoradi refinery was transferred to the employees at market value to be operated as independent business ventures. The inventory in the warehouse was included in the transfer.

ii) The Weija refinery was disposed off, together with all its related fixed assets, to fund Partey’s future business operations and pay off part of the arrears of salaries due to the employees. The employees at this refinery were all reassigned elsewhere. The inventory at the warehouse, valued at cost, was given to the employees as final settlement of their salaries in arrears.

Both the disposal of the Weija refinery and the transfer of the Takoradi refinery to their employees were made on 30 March 2019.

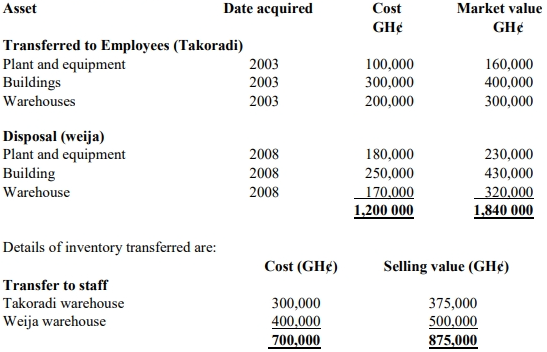

Details of the fixed assets disposed and transferred are:

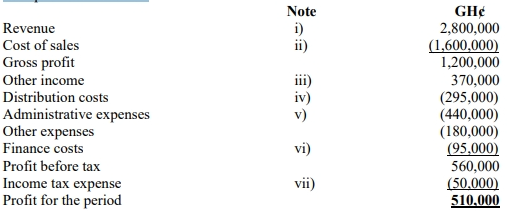

Partey’s statement of profit or loss for the year ended 31 December 2019 in respect of

Mamprobi is as follows:

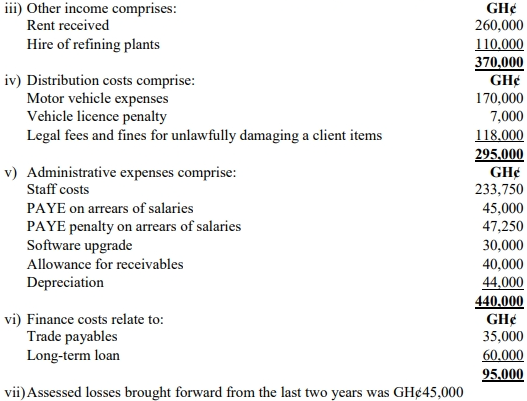

Notes:

i) This amount represents Partey’s ordinary sales for the year.

ii) Included in the cost of sales is the total value of inventory at cost transferred to the

employees (in accordance with the business consultant’s recommendations) on 30 March

2019. No other adjustments were recorded regarding this inventory transfer.

Required:

a) Outline the tax consequences for Partey due to the transfer of the fixed assets and inventory to the employees on 30 March 2019, stating when any taxes should be paid. (4 marks)

b) Assess the tax implications:

i) When the proceeds from the realisation of depreciable assets exceed the written down values? (1.5 marks)

ii) When the proceeds from the realisation of depreciable assets are less than the written down values? (1.5 marks)

c) Calculate the taxable income of Partey for the year ended 31 December 2019. (8 marks)

d) Explain how shareholders of a company are taxed? (5 marks)

Find Related Questions by Tags, levels, etc.