- 1 Marks

BMF – May 2016 – L1 – SA – Q9 – Basics of Business Finance and Financial Markets

This question tests the calculation of Accounting Rate of Return (ARR) for a project based on financial data provided.

Question

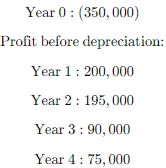

ABC Limited is considering investing in a project with the following financial data:

The project life span is FOUR years and has no residual value at the end of the FOUR years. Calculate the ARR.

A. 25%

B. 30%

C. 32%

D. 33%

E. 35%

Find Related Questions by Tags, levels, etc.

- Tags: ARR, Investment decisions, Project Appraisal

- Level: Level 1

- Topic: Basics of Business Finance and Financial Markets

- Series: MAY 2016