- 1 Marks

AAA – Nov 2011 – L3 – SA – Q17 – Audit Reporting

Identifies the technique involving ratios and statistical analysis to obtain audit evidence.

Find Related Questions by Tags, levels, etc.

Report an error

Find Related Questions by Tags, levels, etc.

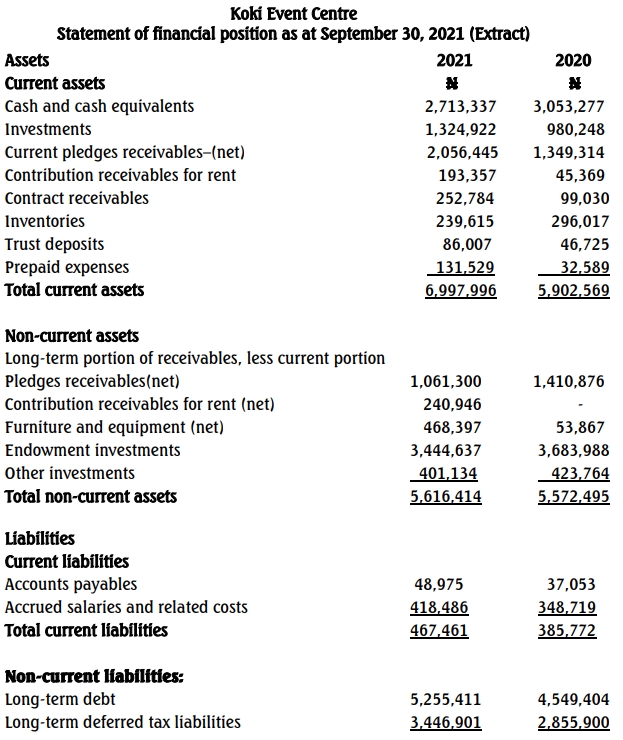

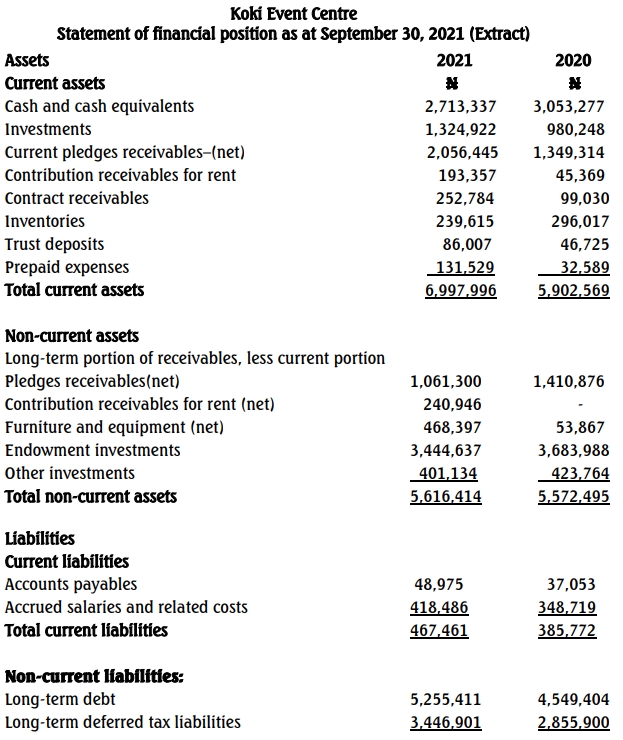

The following information relates to Koki Event Center which is owned and managed by Ogbonge Local Government.

Koki Event Centre

Statement of financial position as at September 30, 2021 (Extract)

Required:

a. Compute the following relevant ratios for the event centre and comment on your results:

i. Current ratio (3 Marks)

ii. Acid test ratio (3 Marks)

iii. Working capital/Total assets ratio (3 Marks)

iv. Total debts/Total assets ratio (3 Marks)

v. Long-term debts/Total assets ratio (3 Marks)

b. Highlight THREE ways by which analytical review can be conducted. (3 Marks)

c. Explain TWO ways the performance appraisal of a profit-oriented entity would differ from that of a public-oriented entity. (2 Marks)

Find Related Questions by Tags, levels, etc.

One of the audit testing procedures available to the auditor is the Analytical Review Procedure.

a. Explain what is meant by Analytical Review Procedures. (6 Marks)

b. Explain FOUR types of general Analytical Review Procedures. (4 Marks)

c. What is the purpose of performing Analytical Review Procedures at the audit planning stage? (5 Marks)

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

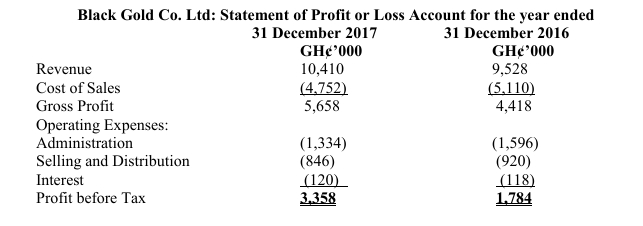

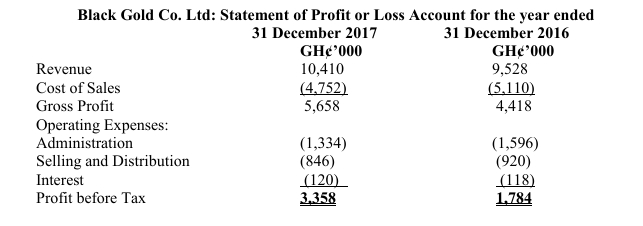

Your audit firm, Beauties Consult, is going to audit for the first time the financial statements of Black Gold Co. Ltd. for the year ended 31 December, 2017. Black Gold Co. Ltd. operates a chain of fuel filling stations in the Greater Accra, Ashanti and Western Regions of Ghana. Customers pay cash for the main products – premium, diesel, and kerosene.

According to its directors, the company has had a “challenging” year and is renegotiating its bank overdraft facility with its bankers. The Statement of Profit or Loss for the year ended 31 December, 2016, is shown below together with the draft Statement of Profit or Loss for the year ended 31 December, 2017.

Required:

As head of the audit team, you are carrying out risk assessment at the planning stage. Perform an analytical review of the draft statement of profit or loss to identify possible risk areas requiring further audit work and provide the necessary risk responses. (12 marks)

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

The following information relates to Koki Event Center which is owned and managed by Ogbonge Local Government.

Koki Event Centre

Statement of financial position as at September 30, 2021 (Extract)

Required:

a. Compute the following relevant ratios for the event centre and comment on your results:

i. Current ratio (3 Marks)

ii. Acid test ratio (3 Marks)

iii. Working capital/Total assets ratio (3 Marks)

iv. Total debts/Total assets ratio (3 Marks)

v. Long-term debts/Total assets ratio (3 Marks)

b. Highlight THREE ways by which analytical review can be conducted. (3 Marks)

c. Explain TWO ways the performance appraisal of a profit-oriented entity would differ from that of a public-oriented entity. (2 Marks)

Find Related Questions by Tags, levels, etc.

One of the audit testing procedures available to the auditor is the Analytical Review Procedure.

a. Explain what is meant by Analytical Review Procedures. (6 Marks)

b. Explain FOUR types of general Analytical Review Procedures. (4 Marks)

c. What is the purpose of performing Analytical Review Procedures at the audit planning stage? (5 Marks)

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Your audit firm, Beauties Consult, is going to audit for the first time the financial statements of Black Gold Co. Ltd. for the year ended 31 December, 2017. Black Gold Co. Ltd. operates a chain of fuel filling stations in the Greater Accra, Ashanti and Western Regions of Ghana. Customers pay cash for the main products – premium, diesel, and kerosene.

According to its directors, the company has had a “challenging” year and is renegotiating its bank overdraft facility with its bankers. The Statement of Profit or Loss for the year ended 31 December, 2016, is shown below together with the draft Statement of Profit or Loss for the year ended 31 December, 2017.

Required:

As head of the audit team, you are carrying out risk assessment at the planning stage. Perform an analytical review of the draft statement of profit or loss to identify possible risk areas requiring further audit work and provide the necessary risk responses. (12 marks)

Find Related Questions by Tags, levels, etc.

Elevate your professional expertise across key business domains with our comprehensive training programs

Follow us on our social media and get daily updates.

This feature is only available in selected plans.

Click on the login button below to login if you’re already subscribed to a plan or click on the upgrade button below to upgrade your current plan.

If you’re not subscribed to a plan, click on the button below to choose a plan