- 20 Marks

ATAX – May 2022 – L3 – Q4 – Taxation of Specialized Businesses

Compute tax liabilities and discuss incentives for Dutse Mines in mining solid minerals

Question

———————————————————————

Question:

As investors and policymakers adapt to the global energy transition in a bid to offer an effective hedge against swings in oil prices, the Federal Government has recognised that it is beneficial for the country to diversify its economy. The attention of the country is now towards the development of the solid minerals sector. The Nigeria Minerals and Mining Act 2007 (as amended) was enacted to regulate the industry. Incentives for operators in the sector are as provided for in Section 5 of the Act.

One of the earliest investors in the mining sector, Dutse Mines (Nigeria) Limited, was granted a mining title by the Mining Cadastre Office (MCO) for exploitation of limestone in Nkalagu in the south-eastern zone of Nigeria in 2008. In spite of so many challenges the company is facing, it has managed to remain afloat in business.

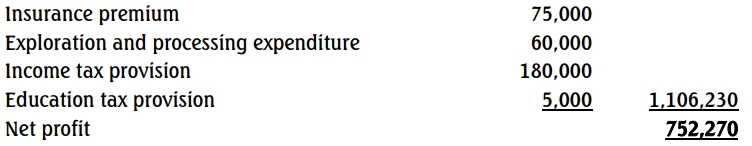

The company has, of recent, been having tax disputes with the relevant tax authority, and your firm of chartered accountants has been engaged to help resolve them. In the 2022 tax returns filed by the company, the major area of dispute between the company and the tax authority was disparity in the treatment of certified exploration and processing expenditure of ₦60,000,000 incurred during the course of the year.

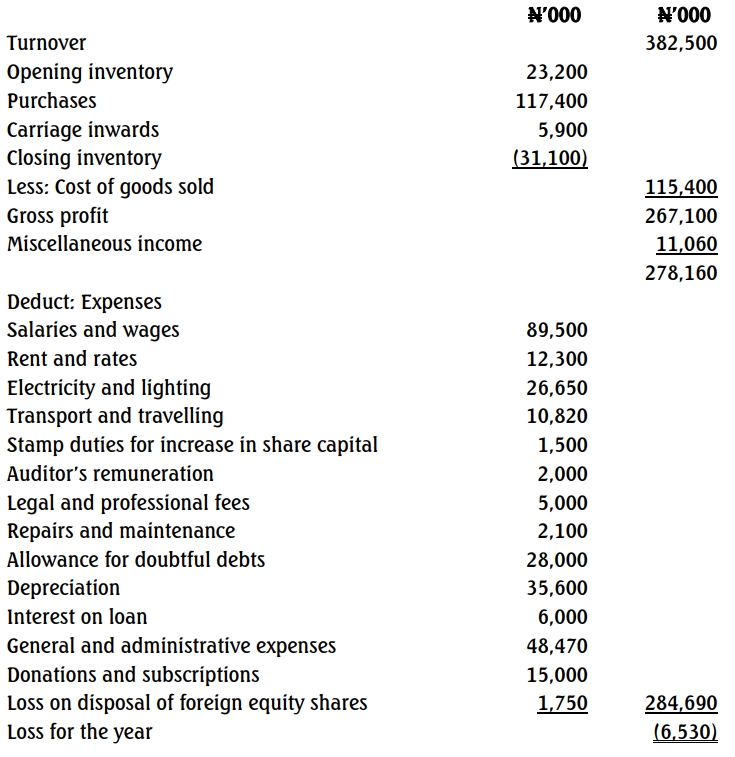

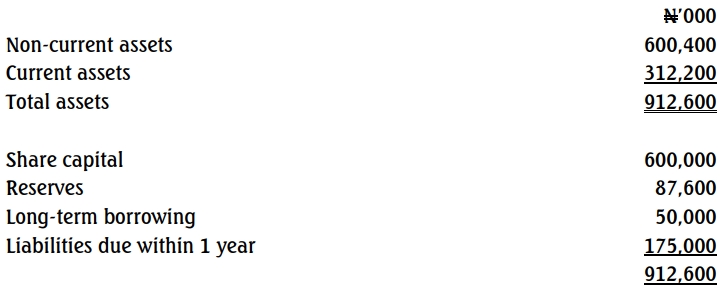

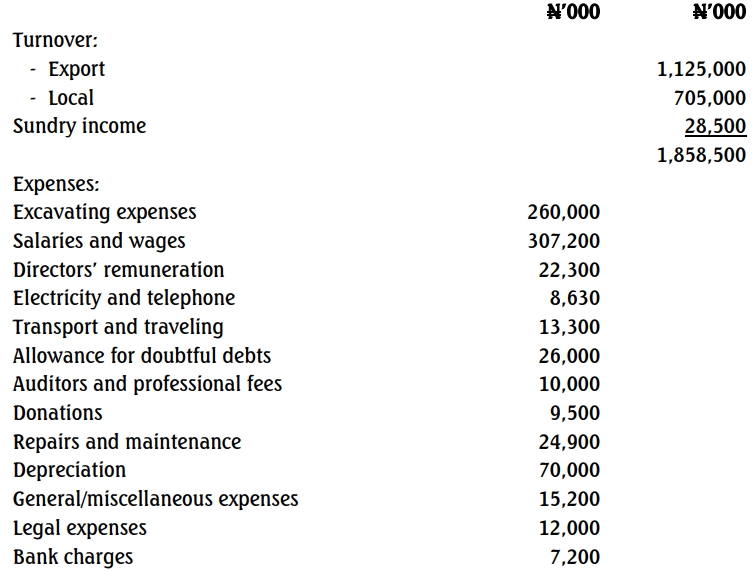

Your firm is provided with the following extracts (and supporting documents) from the books of the company for the year ended December 31, 2021:

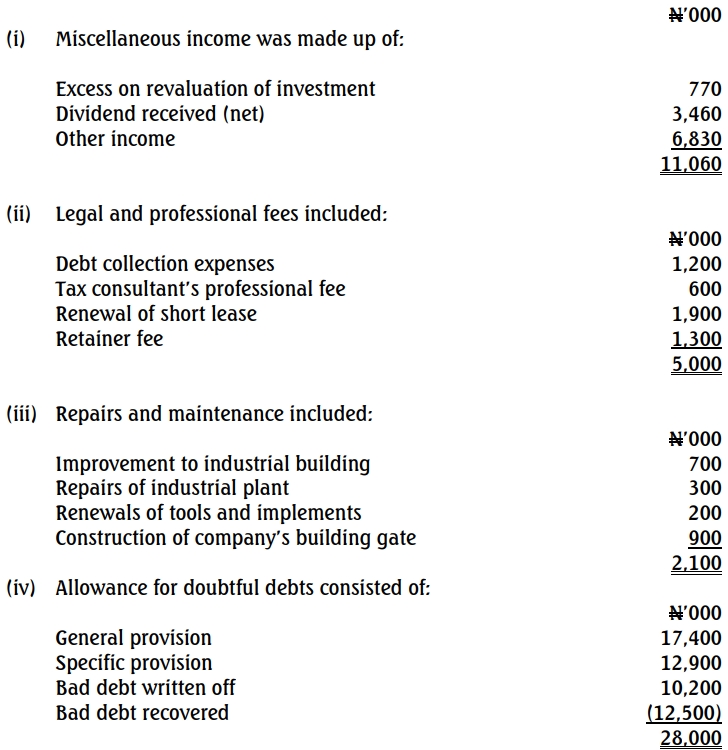

Additional Information:

- Sundry income included ₦8,500,000 realised as profit from disposal of the old excavating machine.

- Allowance for doubtful debts consisted of:

- Bad debts written off: ₦2,500,000

- General allowance for doubtful debts: ₦10,500,000

- Specific allowance for doubtful debts: ₦8,000,000

- Loan to customer written off: ₦5,000,000

- Donation included ₦5,000,000 given to victims of environmental degradation, as part of the company’s social responsibility to the host community.

- Legal fees included ₦750,000 paid as a penalty for late filing of tax returns.

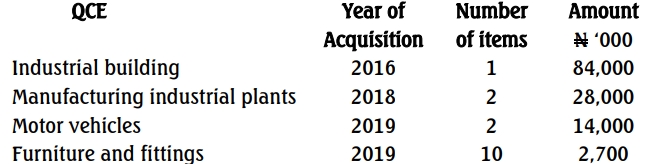

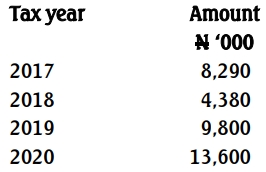

- The tax written down values of qualifying capital expenditure at the end of 2021 tax year were:

- Motor vehicles (2 years remaining): ₦25,000,000

- Furniture and fittings (utilised for 2 years): ₦22,500,000

- Mining expenditure (6 years remaining): ₦40,000,000

Required:

As the Manager (Tax Matters) assigned to handle this matter, you are to forward the report to your Senior Partner (Tax Matters) showing:

a. Computation of tax liabilities of the company for the relevant assessment year (14 Marks).

b. Comments on tax incentives available to a company in the mining of solid minerals in Nigeria (6 Marks).

Find Related Questions by Tags, levels, etc.