- 20 Marks

AT – Nov 2016 – L3 – SB – Q2 – Taxation of Companies

Identify NPDC activities, explain the importance of leases in petroleum operations, and compute adjusted profit, chargeable profit, and chargeable tax.

Question

Nigerian National Petroleum Corporation (NNPC) is one of the regulatory agencies in the Oil and Gas sector of the Nigerian economy. NNPC, through its subsidiaries, carries out various regulatory functions.

a. State any FIVE activities of the Nigerian Petroleum Development Company (NPDC), a subsidiary of NNPC. (5 Marks)

b. State the importance of an Oil Mining Lease and an Oil Prospecting Lease. (2 Marks)

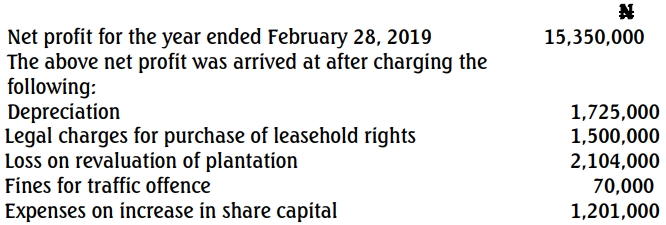

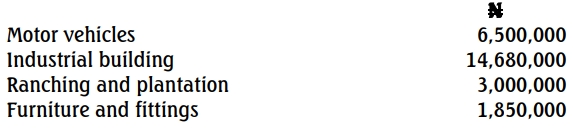

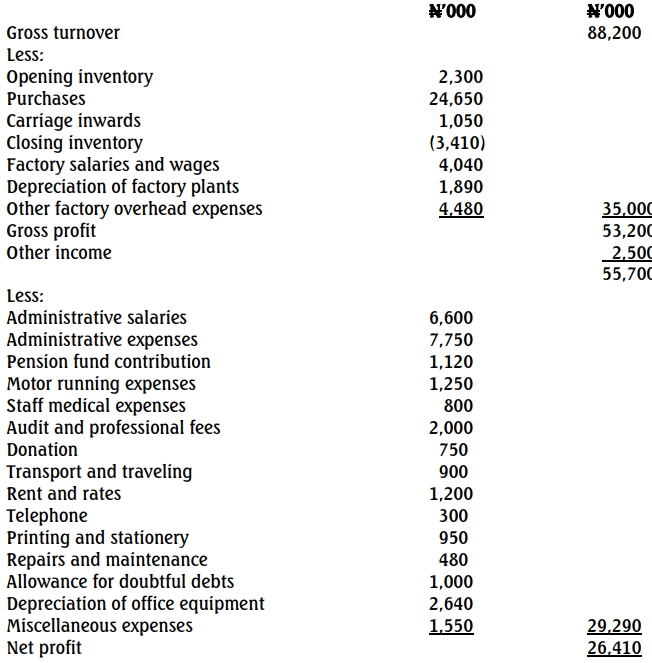

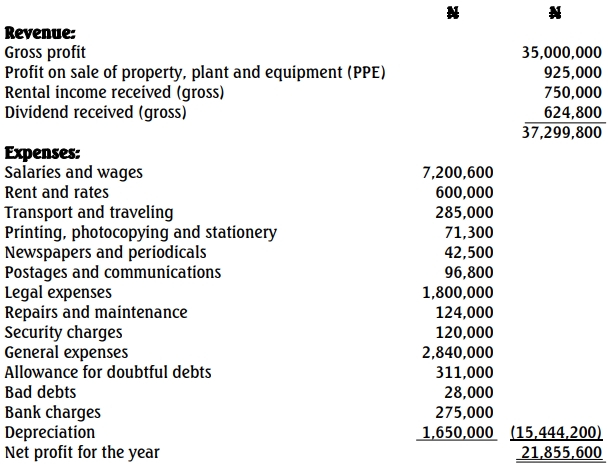

c. **Mr. Gillani Azurhi intimated you about his desire to invest in any company engaged in petroleum operations. One of his friends advised him against the petroleum sector in view of the current low price of crude oil in the international market and the high cost of domestic operations. He declined the advice, arguing that the price will not remain at its current low level as Nigeria will not be in recession forever.

On his own, he carried out some research using the internet. He presented you with the following financial extracts of Joji Petroleum Company Limited, which he obtained from the internet:**

| Details | Amount (₦’000) |

|---|---|

| Current year capital allowances | 6,080 |

| Previous years’ capital allowances (b/f) | 8,901 |

| Custom duty | 125 |

| Royalties not included in the accounts | 1,638 |

| Loss brought forward | 6,250 |

| Petroleum Profits Tax payable | 1,336 |

Assume a tax rate of 85%. You are required to:

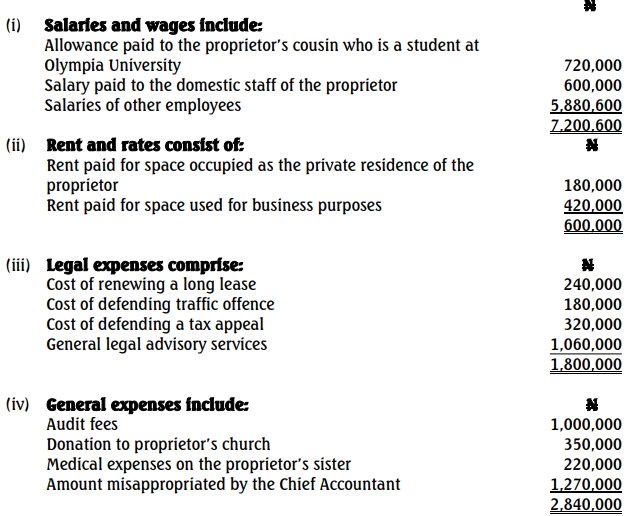

i. Compute and explain the significance of Adjusted Profit. (9 Marks)

ii. Compute and explain the significance of Chargeable Profit. (2 Marks)

iii. Compute and explain the significance of Chargeable Tax. (2 Marks)

Find Related Questions by Tags, levels, etc.