- 22 Marks

PSAF – Nov 2018 – L2 – Q4 – Government Accounting Concepts and Principles

Evaluate the viability of two local government projects using Pay Back Period and Accounting Rate of Return methods.

Question

Sampolopolo Local Government has identified a vacant land beside its marriage registry building. The director of administration proposed that the land be used either for a cybercafé where the general public can browse, make phone calls, photocopy and carry out other computer services or for the construction of an entertainment event-hall that can be rented out on a commercial basis.

This idea was tabled at the council’s management meeting and unanimously accepted. However, the Finance and General Purposes Committee recommended five years for the project since the council secretariat building will be extended in the future to accommodate more offices for the increased staff strength, and this was approved.

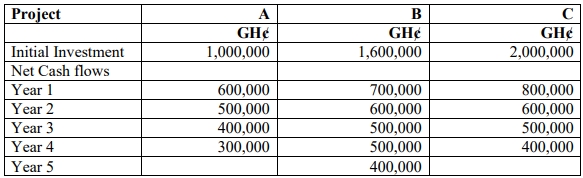

The cost of building the cybercafé and the event-hall with necessary facilities and fittings as well as the expected cash inflows/profits as prepared by the director of administration are as follows:

Required:

As the consultant engaged by Sampolopolo Local Government, advise the Local Government on the more viable project using:

i. Pay Back Period (PBP) (7 Marks)

ii. Accounting Rate of Return (ARR) (13 Marks)

Find Related Questions by Tags, levels, etc.