- 15 Marks

AAA – May 2022 – L3 – Q7 – Risk Management in Audits

Evaluate key risk areas for auditors in consolidating Nigerian and UK company accounts, considering transfer pricing and related party transactions.

Question

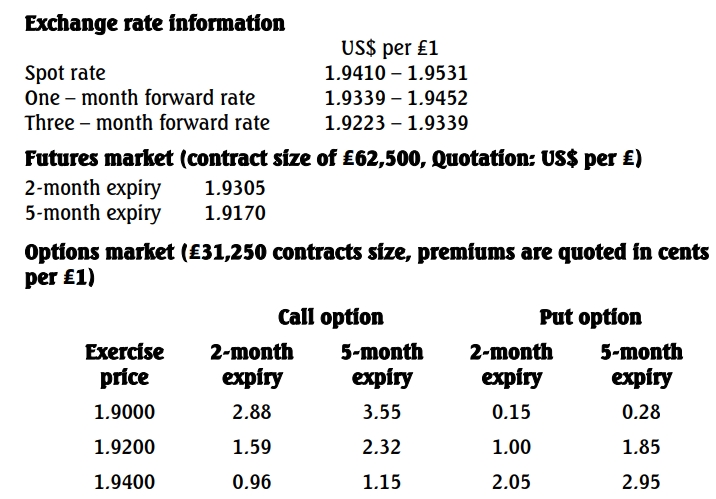

BARCHI International Limited is a company with corporate registrations in both the United Kingdom (U.K.) and Nigeria. The Chairman of the company is based in Nigeria and from time to time travels to the U.K. to oversee the office there and order for the purchase of some of the articles for sale. To ensure steady supply of the products, some of the products are also ordered from China. The purchases from the U.K. are charged to the Nigerian entity in pound sterling, while the purchases from China are charged to the Nigerian company in American dollars.

In September 2020, the Chairman embarked on a trip to Dubai for two weeks where he spent part of his annual holiday. During this period, he hosted a couple of friends with the costs that were paid for by the company as the costs were above his approved annual holiday expenses. He subsequently traveled to the U.K. and was quarantined for two weeks due to COVID-19 before moving to the usual business lodge that he uses. Despite using that period to oversee the U.K. company, all the costs incurred were borne by the Nigerian company.

The products bought in the U.K. and sent to Nigeria were charged at cost plus 25%, while the Nigerian company was responsible for insurance and freight. The goods purchased from China were forwarded to Nigeria at the cost of landing in Nigeria plus 30%. The China-made products are less expensive and therefore give better profits despite the cost of the long-distance freight.

Money was transferred to the Chairman’s account for the company’s purchases in the U.K., the purchases made in China, and the Chairman’s personal expenses. An agent in China bought the goods which were paid for by the Chairman.

The U.K. company staff handled the documentation of all the transactions of the Chairman while there and transferred them to Nigeria subject to the approval of the Chairman.

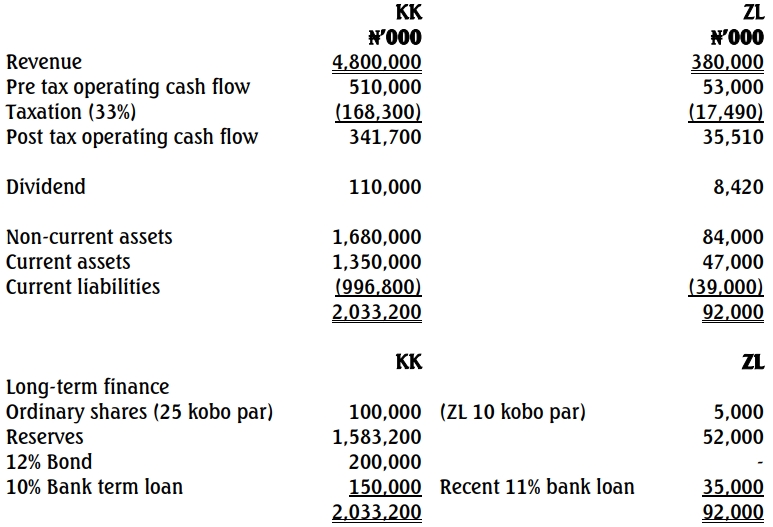

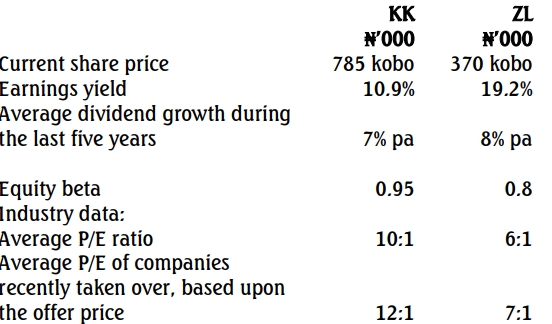

Separate records were not maintained for the Chairman’s expenses in the U.K. However, his comparison of the results of the two units showed that for the immediate past financial year, the Nigerian company had performed sub-optimally and way below the targeted profit in relation to the U.K. company. The Chairman is very unhappy about this as he expects that his personal visit to the U.K. would reduce the purchasing and associated costs.

It is usual for the Chairman to account for the cost of purchases based on his personal expenses attributable to each purchase together with the actual cost of purchases. The U.K. component is elated about this costing method which favors it and would wish that this arrangement continues.

The two units prepare separate financial statements which are audited by separate accounting firms before the two financial statements are consolidated in Nigeria for the Chairman’s evaluation.

Required:

Evaluate, with appropriate justifications, from the scenario above, the areas of risk which the auditor needs to consider. (15 Marks)

Find Related Questions by Tags, levels, etc.