- 15 Marks

ATAX – May 2022 – L3 – Q6 – Taxation of Non-Resident Companies and Individuals

Discuss the tax implications of an overseas branch and compute the associated tax liabilities.

Question

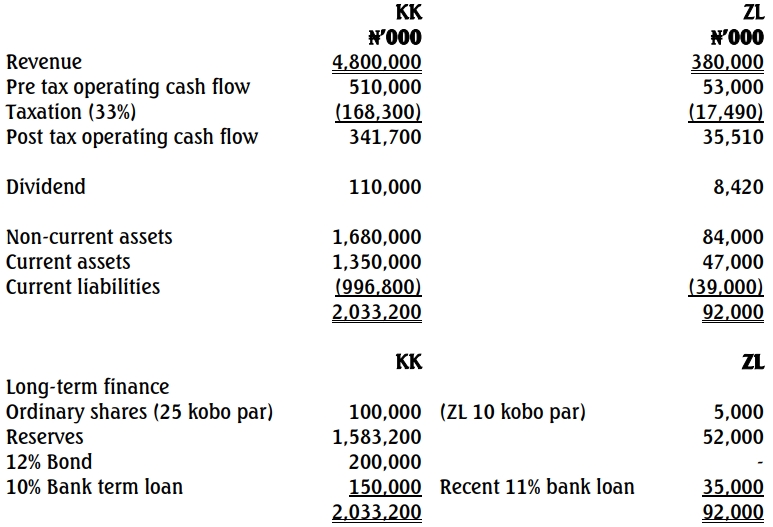

Maigona Agro Limited is a Nigerian company operating in the agricultural sector. It has a large expanse of land in the Northern part of the country, which is used strictly for the cultivation of cotton seeds. As a result of the collapse of the textile/garment industry, specifically due to the unfavourable business climate in Nigeria, the company in 2015 established a branch, BAM Textile Mills, in the United Kingdom. Part of the cotton produced locally is sold to BAM Textile Mills at a competitive price, for the production of finished product (branded textile clothing).

A tax dispute recently arose between the Management of Maigona Agro Limited and officials of the Federal Inland Revenue Service (FIRS) on the correct assessment of profits made by BAM Textile Mills. The Managing Director is of the opinion that the tax paid by BAM Textile Mills in the United Kingdom should be the final tax since the company is only an overseas branch. He further averred that the provisions of the Companies and Allied Matters Act 2020 (as amended) are only applicable to companies incorporated in Nigeria. The Managing Director was furious when the company received a reminder of notice of assessment from the FIRS and has therefore threatened to approach the Tax Appeal Tribunal for redress.

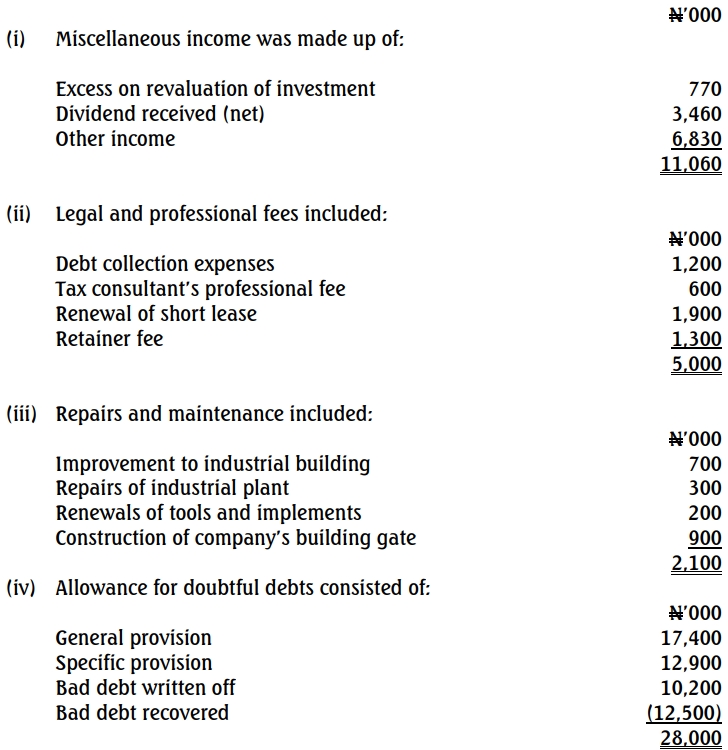

You have been engaged by the company as its Tax Consultant to provide professional advice on the tax implication of the profit made by BAM Textile Mills, UK and possibly representation at the Tax Appeal Tribunal sittings. The statement of profit or loss for the year ended October 31, 2021 (BAM Textile Mills’ result has been converted to Nigerian Naira at the prevailing exchange rate) and other relevant documents were handed over to you by the Managing Director.

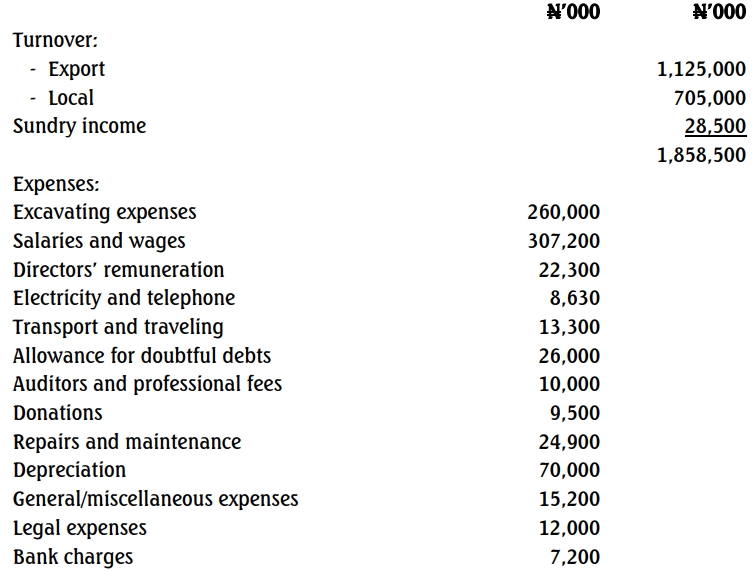

The extracts from the statements of profit or loss of the two corporate entities revealed the following:

| Maigona Agro Ltd (N’000) | BAM Textile Mills (N’000) | Total (N’000) | |

|---|---|---|---|

| Gross Turnover | 975,100 | 1,820,500 | 2,795,600 |

| Less: | |||

| Cost of materials/inputs | 350,200 | 672,000 | 1,022,200 |

| Salaries and Wages | 122,530 | 400,400 | 522,930 |

| Administrative Expenses | 45,700 | 110,900 | 156,600 |

| Depreciation | 75,600 | 147,300 | 222,900 |

| Donation | 8,500 | 0 | 8,500 |

| Share of Head Office Expenses | 33,300 | 50,000 | 83,300 |

| Income Tax Paid in the UK | 0 | 72,200 | 72,200 |

| Total Expenses | 635,830 | 1,452,800 | 2,088,630 |

| Net Profit | 339,270 | 367,700 | 706,970 |

Additional Information:

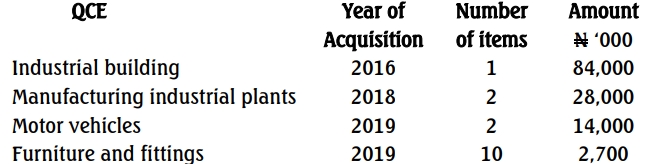

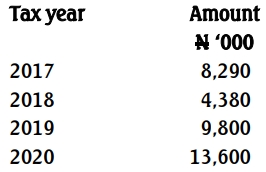

- The capital allowances of Maigona Agro Limited in respect of plant and equipment, farming tools, and other qualifying capital expenditure as agreed with the tax authorities was N45,000,000. The amount of capital allowances of N57,000,000 claimable by BAM Textile Mills on qualifying assets was also certified by the tax authorities.

- Included in the donation was N5,000,000 given to victims of the COVID-19 (Omicron variant) pandemic in Nigeria.

- The UK tax rate is assumed to be 35%.

Required:

a. Advise the management of Maigona Agro Limited on the tax implications of the overseas branch. (4 Marks)

b. Compute the tax liabilities of the company in line with your submission in (a) above. (11 Marks)

Find Related Questions by Tags, levels, etc.