Statement of profit or loss and other comprehensive income for the year ended 31 December 2019 of Kingdom Ltd and Paradise Ltd.

| Description |

Kingdom Ltd (GH¢000) |

Paradise Ltd (GH¢000) |

| Revenue |

125,200 |

60,000 |

| Cost of sales |

(91,600) |

(48,000) |

| Gross profit |

33,600 |

12,000 |

| Distribution costs |

(4,000) |

(2,400) |

| Administrative expenses |

(7,000) |

(3,600) |

| Finance costs |

(400) |

0 |

| Profit before tax |

22,200 |

6,000 |

| Income tax expenses |

(6,200) |

(2,000) |

| Profit for the year |

16,000 |

4,000 |

| Other comprehensive income: Gain on revaluation of property |

3,000 |

0 |

| Total comprehensive income |

19,000 |

4,000 |

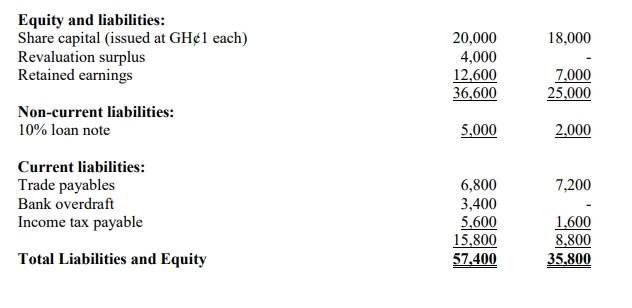

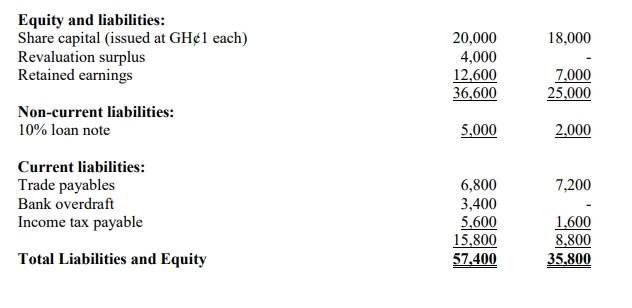

Statement of financial position as at 31 December 2019

| Description |

Kingdom Ltd (GH¢000) |

Paradise Ltd (GH¢000) |

| Assets |

|

|

| Non-current assets: |

|

|

| Property, plant, and equipment (PPE) |

37,400 |

27,800 |

| 10% loan note |

2,000 |

0 |

| Total non-current assets |

39,400 |

27,800 |

| Current assets: |

|

|

| Inventory |

8,600 |

2,400 |

| Trade receivables |

9,400 |

5,000 |

| Bank |

0 |

600 |

| Total current assets |

18,000 |

8,000 |

| Total assets |

57,400 |

35,800 |

Additional relevant information:

i) Kingdom Ltd acquired 60% of the share capital of Paradise Ltd on 1 April 2019. The purchase consideration was settled by a share exchange transaction of two shares in Kingdom Ltd for every three acquired shares in Paradise Ltd. The share price of Kingdom Ltd at the acquisition date was GH¢3 per share. In addition, Kingdom Ltd will also pay cash consideration of GH¢0.275 on 1 April 2020 for each acquired share in Paradise Ltd. Kingdom Ltd’s cost of capital is 10% per annum. None of the consideration has been recorded by Kingdom Ltd.

ii) The fair values of Paradise Ltd’s net assets and liabilities were equal to their carrying amounts at the date of acquisition with the exception of Paradise’s property, which had a fair value of GH¢8 million above its carrying amount. For the purpose of consolidation, this led to an increase in depreciation charges (in cost of sales) of GH¢200,000 in the post-acquisition period to 31 December 2019. Paradise Ltd has not incorporated the fair value of property increase into its entity’s financial statements.

iii) The policy of Kingdom Ltd group is to value all properties to fair value at each year end. On 31 December 2019, the increase in Kingdom Ltd’s property has already been recorded. However, a further increase of GH¢1.2 million in the value of Paradise Ltd’s property since its value at acquisition to 31 December 2019 has not yet been recorded.

iv) Kingdom Ltd made sales to Paradise Ltd throughout the year 2019 and it had consistently been GH¢600,000 per month. Kingdom Ltd made a mark-up of 25% on all of these sales. A total of GH¢1.2 million (at cost to Paradise) of Paradise Ltd’s inventory at 31 December 2019 had been supplied by Kingdom Ltd during the post-acquisition period.

v) At 31 December 2019, Kingdom Ltd had a trade receivable balance owing from Paradise Ltd of GH¢2.4 million. However, this did not agree to the equivalent trade payable of Paradise Ltd as a result of a payment by Paradise Ltd of GH¢800,000 made in December 2019, which did not reflect in Kingdom Ltd’s bank account until 4 January 2020. Kingdom Ltd’s policy for cash timing differences is to adjust the parent’s financial statements.

vi) Kingdom Ltd on December 2019, accepted a GH¢1 million 10% loan note from Paradise Ltd.

vii) At 31 December 2019, the goodwill that arose on acquisition was impaired by GH¢1 million. Kingdom Ltd has a policy of treating goodwill impairment as part of administrative expense.

viii) It is the policy of Kingdom Ltd group to value the non-controlling interest at fair value. For this purpose, Paradise Ltd’s share price was trading at GH¢2.50 each at the acquisition date.

ix) Assume that all items of income and expenditure accrue evenly throughout the year except where indicated otherwise.

Required:

a) Prepare the consolidated statement of profit or loss and other comprehensive income for Kingdom Ltd group for the year ended 31 December 2019. (10 marks)