Disposal of assets is an important concept in the determination of capital gains tax payable. Section 6 of the Capital Gains Tax Act 2004 (as amended) specifically provides that a disposal of assets by a person occurs where any capital sum is derived from a sale, lease, transfer, an assignment, a compulsory acquisition, or any other disposition of assets, notwithstanding that no asset is acquired by the person paying the capital sum. In the same vein, Section 2 (4) of the Finance Act 2020 states the period for filing of self-assessment returns and when payment of the tax computed in respect of chargeable assets disposed of is to be made.

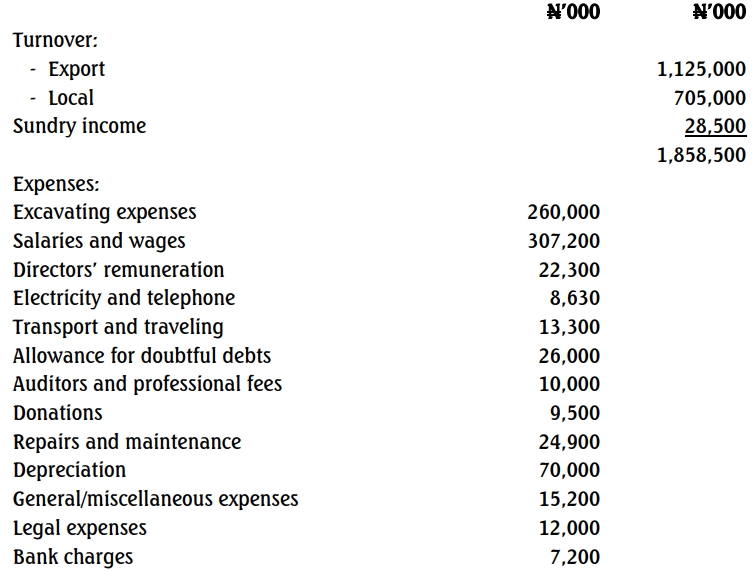

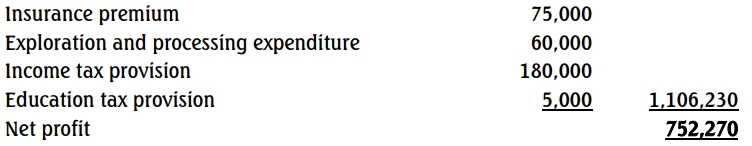

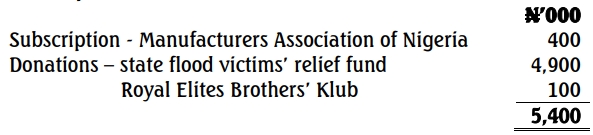

Nice-One Nigeria Limited, a manufacturing concern, with head office in Calabar and branches in Ikeja, Kano, and Abuja, has been in business for several years, reporting its accounts to December 31 of every year. The extracts from the books of accounts of the company during the year ended December 31, 2021, revealed the following transactions:

(i) Disposal of an option

On February 1, 2021, the company sold an option on a piece of land in Ikeja for the sum of ₦8,500,000 to Eco-Raheem Limited, which subsequently exercised the right by purchasing the land for ₦32,200,000.

(ii) Acquisition of asset in exchange for debt

On March 15, 2021, one of the company’s debtors in Calabar, Mr. Baba Tee, reached an agreement with the company by exchanging his piece of land, which was valued at ₦15,000,000, for the debt of ₦13,500,000. The company, on May 7, 2021, disposed of the land for ₦18,000,000. Incidental expenses incurred towards the disposal of the land were ₦250,000.

(iii) Disposal of a building

The company has a staff estate, which comprises five buildings in its Abuja branch. In order to source funds to construct a new staff estate in Kano, the company, on August 12, 2021, sold one of its buildings in the Abuja estate for ₦110,000,000. The cost of acquisition of the five buildings in the estate was ₦250,000,000. The cost of acquisition of the building sold was ₦75,000,000, while the remaining buildings unsold were professionally valued at ₦240,000,000. The company also incurred for the purpose of the disposal of the building, ₦400,000 on building repairs and a professional valuer’s fee of ₦1,100,000.

(iv) Disposal of industrial plants

One of the company’s industrial plants in the Kano branch, which cost ₦4,500,000, was disposed of on September 15, 2021, for ₦6,000,000. A new plant was bought for the purpose of the company’s operations the following month for ₦8,000,000. During the installation of the new plant, it was found that the plant could not efficiently satisfy the requirements of the company and it was subsequently sold on December 2, 2021, as “second-hand” for ₦7,300,000. The company incurred the sum of ₦25,000 as disposal expenses.

The Managing Director of the company is of the opinion that issues around the transactions undertaken by the company in the financial year are “technical,” which only competent professional accountants with experience in tax matters can conveniently handle. Accordingly, your firm of accountants was contacted to help provide tax advice on each of the above transactions.

Required:

You have been directed by your firm’s Head (Tax Matters) to take charge of the assignment and submit a report to him by the close of work in three days.

Your report should specifically cover:

(a) The principles of disposal as provided for in Section 6 of the Capital Gains Tax Act 2004 (as amended) (3 Marks).

(b) Computation of capital gains tax payable and when the tax due is to be paid to the relevant tax authority for the following stated transactions:

i. Disposal of an option in Ikeja branch (2 Marks).

ii. Acquisition of asset in exchange for debt in Calabar head office (3 Marks).

iii. Disposal of a building in Abuja branch (4 Marks).

iv. Disposal of industrial plants in Kano branch (8 Marks).