- 20 Marks

TAX – Nov 2023 – L2 – Q4 – Taxation of Trusts and Estates

Compute the net income assessable in the hands of trustees and assessable income of each beneficiary.

Question

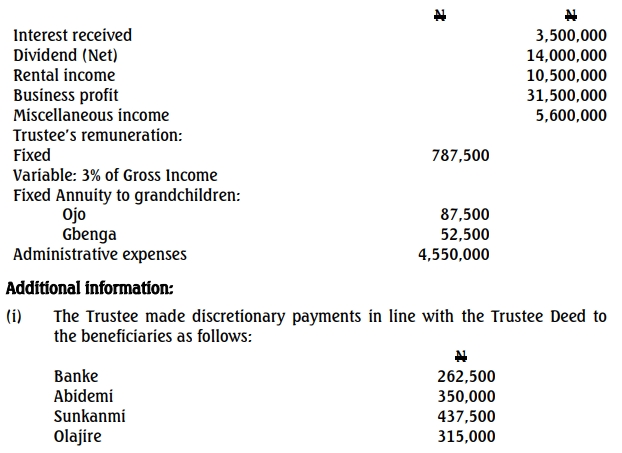

The records of the two trustees of Olalomi Children Settlement created in favor of the three children—Olami, Olambe, and Olaide—revealed the following as of December 31, 2020:

| Income Type | Amount (N) |

|---|---|

| Rental income (gross) | 398,900 |

| Trading income | 210,000 |

| Dividend (gross) | 196,000 |

| Profit on sale of non-current assets | 600,000 |

Additional Information:

- The interest received was from Gbogbo-Ero Commercial Bank Limited.

- Other allowable expenses amounted to N23,000.

- Each beneficiary was entitled to a quarter of the net distributable income.

- Fixed annuity to the beneficiaries was N42,000 (gross) to be shared equally.

- Trustee’s remuneration per trust deed was fixed at N25,000 each, plus 2.5% of the total computed income.

- Discretionary payments were made to Olami (N10,000), Olambe (N34,000), and Olaide (N29,000).

- Agreed capital allowance was N87,600.

- Administrative and other expenses amounted to N106,000.

Required: a. Compute the net income assessable in the hands of the trustees. (14 Marks)

b. Compute the assessable income in the hands of each beneficiary. (6 Marks)

Find Related Questions by Tags, levels, etc.