- 15 Marks

ATAX – May 2016 – L3 – Q5 – Taxation of Companies

Compute the original and revised tax liabilities of Atlas Nigeria Limited, considering tax official adjustments.

Question

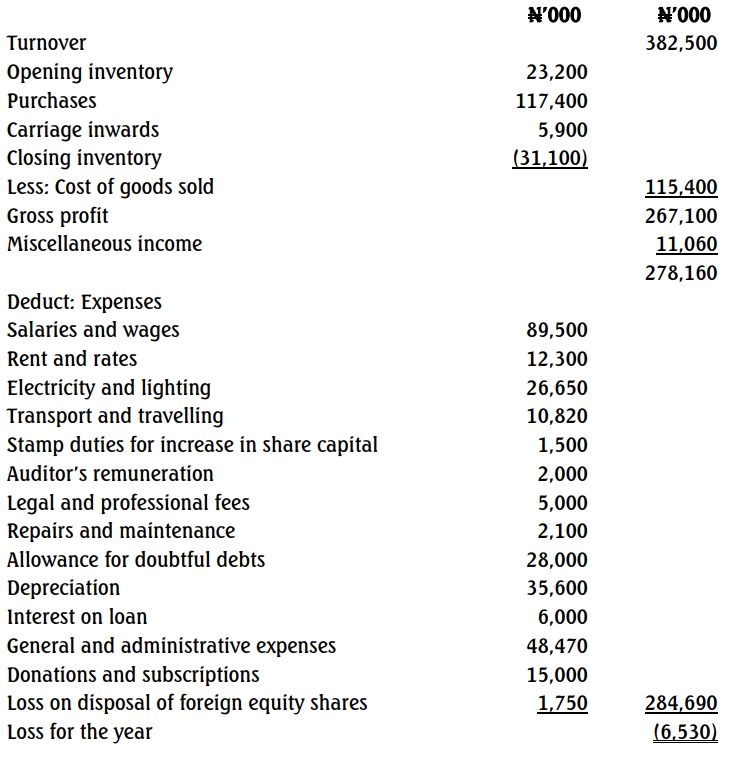

Atlas Nigeria Limited is into the sale of Mobile Phones, and the company’s year-end is December 31 of each year. The company’s Annual Tax Returns for the year ended December 31, 2012, were submitted in January 2014. Tax officials found a number of irregularities during a routine examination of the Tax Returns. They discovered that trade payables included N940,000 representing VAT for the two months to December 31, 2012. All sales attract VAT. There was no Input VAT during 2012. Tax officials were, however, of the opinion that the income of the company accrued uniformly throughout the 12 months of the year.

The accounts showed Adjusted Profits of N44,062,500, and Capital Allowances totaled N33,025,000. The tax liability arrived at was N4,406,250. The tax officials were not satisfied with the explanations received in connection with the Withholding Tax on the Director’s fee of N1,562,500, as well as Consultancy fee of N812,500. They also decided to write back 2/3 of the following expenses:

- Printing and Stationery N168,750

- Donations and Subscription N1,320,620

- Losses claimed, amounting to N128,025 was disallowed. Included in the adjusted profit figure is N6,962,500 for Depreciation.

REQUIRED:

i. Show the computations resulting in the Original Tax Liability of N4,406,250 (5 marks)

ii. Compute a revised Tax liability based on the findings of the Tax Officials (10 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Adjusted Profits, Depreciation, Donations, Tax liabilities, Withholding Tax

- Level: Level 3

- Topic: Taxation of Companies