- 30 Marks

ATAX – May 2016 – L3 – Q1 – Tax Incentives and Reliefs

Assess tax liabilities, the appropriateness of proposed dividends, and discuss pioneer product tax relief, including anti-avoidance measures.

Question

You have just received an e-mail from the Senior Manager of the Tax Division of your firm of Tax Consultants.

The E-mail:

“We have just received a memo from the Audit and Assurance Division with respect to two of our clients. Curiously, the two companies have identical issues of Dividend Payments. The details are as follows:

(1) XYBLEX (Nigeria) Limited is a Pharmaceutical Manufacturing company located in Otta, Ogun State, Nigeria. It is a Subsidiary of XYBLEX PHARMACEUTICALS in Europe. At its recent Board Meeting of February 15, 2016, two resolutions were passed:

(a) A proposed dividend of 15 kobo per share subject to appropriate withholding tax deduction for the year ended December 31, 2015, to be presented to members at its Annual General Meeting on June 30, 2016.

(b) That having obtained the Patent Rights for a new drug for Arthritis called “Arthritobex,” production is expected to commence in the third quarter of the year 2016.

(2) KRYSTOL Limited is a Trading Company located in Lokoja, Kogi State, Nigeria. The Board Resolution of January 29, 2016, proposed a Dividend of 25 kobo per share subject to appropriate Withholding Tax deduction for the year ended December 31, 2015, to be presented to members at its Annual General Meeting scheduled for May 5, 2016.

It is essential to state that Johnbull Martins, the new Trainee, did make efforts to determine the Tax liabilities of the two Companies, but these are to be properly checked.

Required:

You are to review the computation by Johnbull Martins and come up with a correct position of the Tax Liability of the two Companies.

It is also essential that you determine the adequacy of the proposed Dividend by the two Companies to ensure compliance with the provisions of the Companies Income Tax Act Cap C21 LFN 2004.

Finally, since XYBLEX (Nigeria) Limited is proposing to start production of “Arthritobex” in the third quarter of the year, the Managing Director would like to present to the Board the Firm’s opinion on Pioneer Products with specific reference to:

- Tax Relief Period

- Profits and Dividends

Below are the relevant details in respect of both Companies for the year ended December 31, 2015:

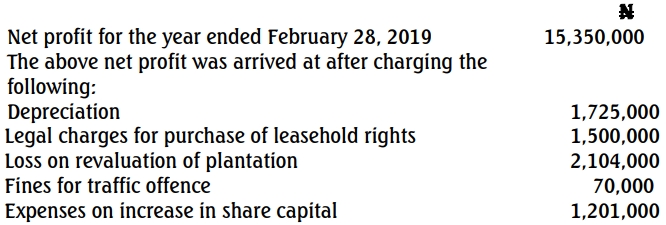

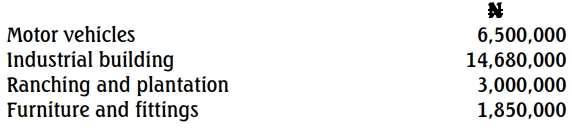

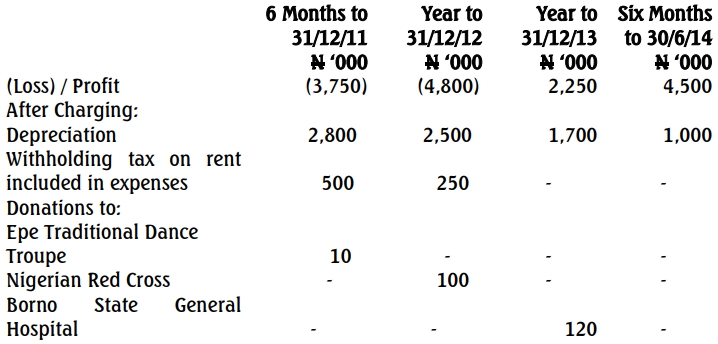

| Details | XYBLEX (Nigeria) Limited | Krystol Limited |

|---|---|---|

| Net Profit Per Account | N 20,025,420 | N 40,251,240 |

| Balancing Charge | – | 1,125,000 |

| Investment Allowance | 8,285,400 | – |

| Profit on Sale of Non-Current Assets | 6,845,150 | – |

| Capital Allowance for the Year | 18,329,700 | 19,684,850 |

| Depreciation | 10,052,500 | 7,250,600 |

| Net Assets | 350,000,000 | 326,250,000 |

| Turnover | 125,350,000 | 102,500,000 |

| Paid-up Capital (Ordinary Shares of N1.0 each) | 100,000,000 | 120,000,000 |

| Gross Profit | 75,000,000 | 62,000,000 |

| Revenue Reserve | 102,350,200 | 165,280,000 |

a. Compute the tax liabilities of the two Companies. (8 Marks)

b. Advise on the appropriateness of the proposed Dividends with reference to the relevant provisions of the Law. (12 Marks)

c. Outline the Tax Relief Period and the relevant provisions with respect to Profits and Dividends of Pioneer Companies. (5 Marks)

d.

i. Explain briefly “Tax Avoidance.”

ii. List THREE Anti-Avoidance measures put in place by the Government (Ignore Double Taxation Measures). (5 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Anti-Avoidance, Dividend Payments, Pioneer Products, Tax liabilities

- Level: Level 3

- Topic: Tax Incentives and Reliefs