- 10 Marks

CR – May 2021 – L3 – Q1c – Property, Plant and Equipment (IAS 16)

Record journal entries for PPE acquisition and related foreign exchange adjustments in the books of Ngono Plc.

Question

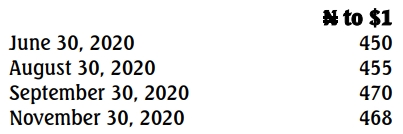

c. Ngono Plc. has a financial year end of September 30. The Company buys property, plant and equipment for its office in Nigeria from foreign supplier Omaha Inc. in USA. On June 30, 2020, Ngono Plc. took delivery of PPE from Omaha Inc. with invoice value amounting to $100,000 and is due for settlement in equal instalments on August 30, 2020 and November 30, 2020. Clearing cost and import duty paid on the acquisition of the PPE amounted to N1,250,000. It is the policy of Ngono Plc to depreciate PPE at 20% on cost using the straight –line method. The depreciation is provided in full in the year of acquisition and none in the year of disposal.

Both Ngono Plc. and Omaha Inc. honoured their own part of the agreement in the transaction.

Movement recorded in the exchange rate were as follows:

Required:

Show the journal accounting entries to record the above transaction in the books of Ngono Plc. (10 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Depreciation, Foreign Exchange, Journal Entries, PPE

- Level: Level 3