Topic: Presentation of financial statements

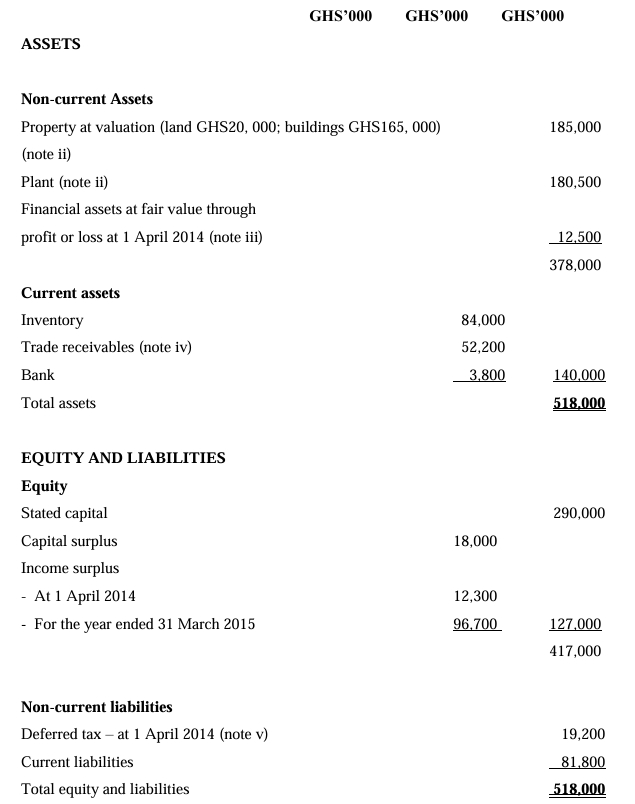

- 20 Marks

FR – March 2024 – L2 – Q3 – Preparation of Financial Statements

Preparation of the statement of comprehensive income for Skolom Ltd.

Question

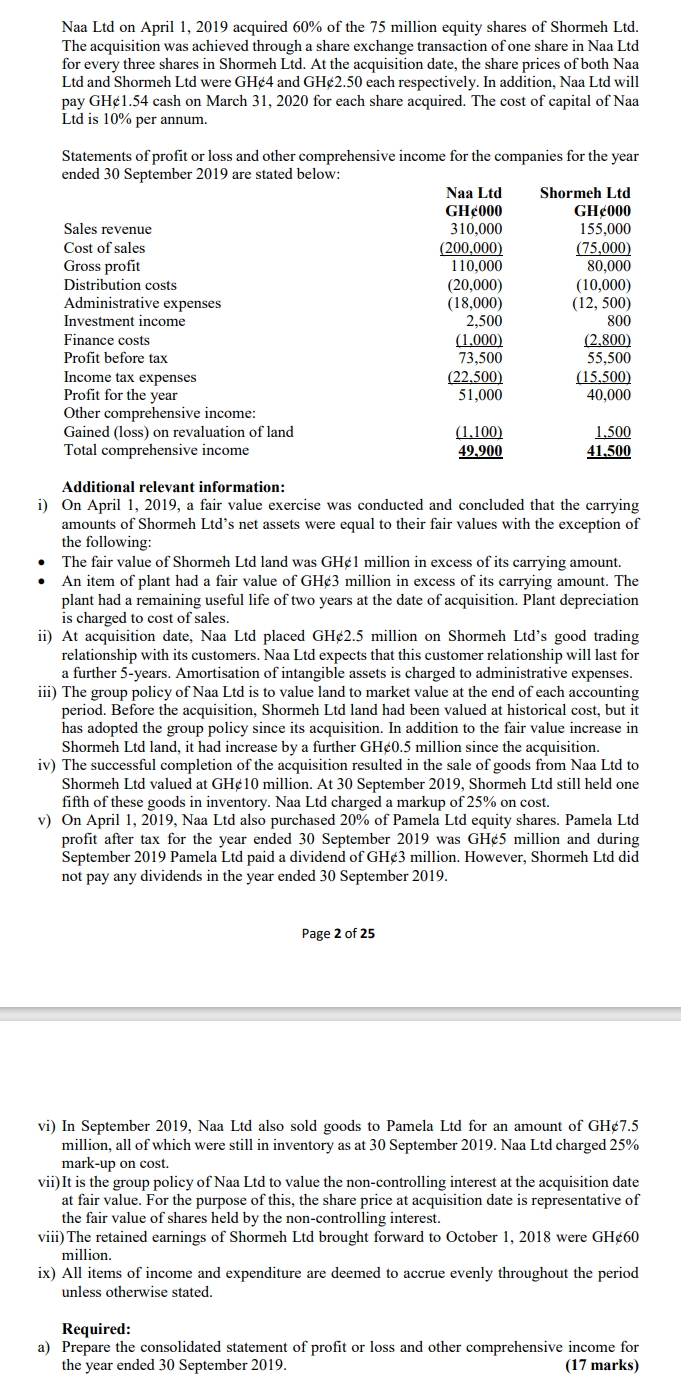

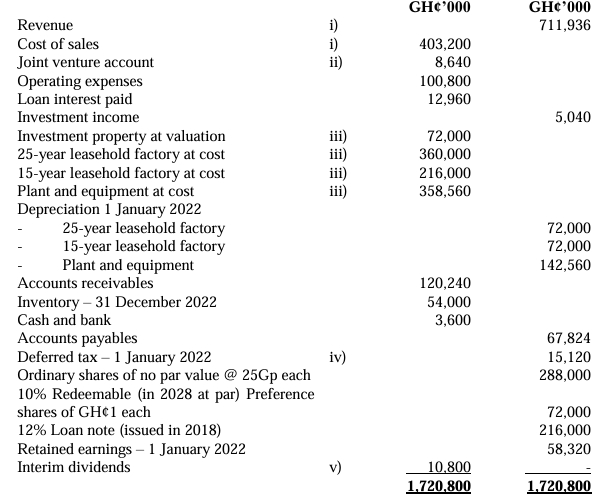

The following figures have been extracted from the accounting records of Skolom Ltd on 31 December 2022:

Additional information provided includes notes on Skolom Ltd’s agency arrangements with Keke Ltd, joint venture details, and depreciation policies.

Required:

Prepare for Skolom Ltd in accordance with International Financial Reporting Standards (IFRSs):

a) Statement of Comprehensive Income for the year ended 31 December 2022

b) Statement of Financial Position as at 31 December 2022

Find Related Questions by Tags, levels, etc.

- 20 Marks

FR – Nov 2016 – L2 – Q3 – Preparation of Financial Statements

Prepare the financial statements of Kwadaso Ltd, including profit or loss, changes in equity, and financial position for the year ended 30 September 2015.

Question

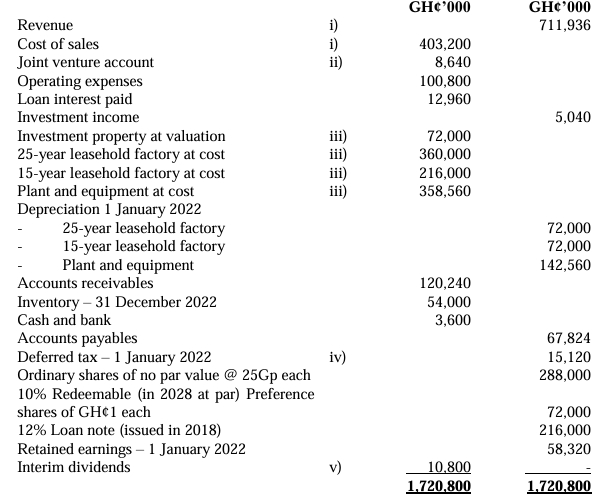

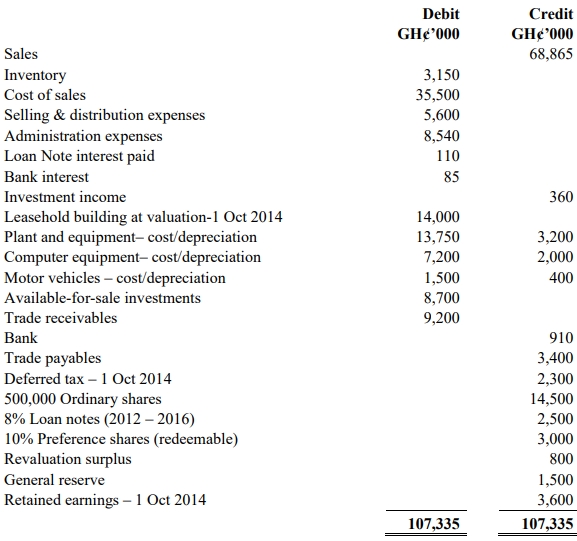

The following is the trial balance of Kwadaso Ltd, a trading company, as at 30 September 2015:

Additional Information:

- On 31 March 2015, the company made a bonus issue from retained earnings of one new share for every four shares in issue at GH¢10.00 each. This transaction is yet to be recorded in the books. The company paid ordinary dividends of GH¢2.2 per share on 31 January 2015 and GH¢2.6 per share on 30 June 2015. The dividend payments are included in administrative expenses in the trial balance.

- Provision is to be made for a full year’s interest on the Loan notes.

- The finance charge relating to the preference shares is equal to the dividend payable.

- Non-current assets:

- Depreciation of Property, Plant, and Equipment is to be provided on the following bases:

- Plant and equipment – 10% on cost

- Computer equipment – 25% on cost

- Motor vehicles – 20% on reducing balance

- No depreciation has yet been charged on any non-current asset for the year ended 30 September 2015.

- Kwadaso revalues its buildings at the end of each accounting year. At 30 September 2015, the relevant value to be incorporated into the financial statements is GH¢14,100,000. The building’s remaining life at the beginning of the current year (1 October 2014) was 25 years. Kwadaso does not make an annual transfer from the revaluation reserve to retained earnings in respect of the realisation of the revaluation surplus. Ignore deferred tax on the revaluation surplus.

- Depreciation of Property, Plant, and Equipment is to be provided on the following bases:

- The available-for-sale investments held at 30 September 2015 had a fair value of GH¢8,400,000. There were no acquisitions or disposals of these investments during the year.

- In February 2015, Kwadaso’s internal audit unit discovered a fraud committed by the company’s credit manager who did not return from a foreign business trip. The outcome of the fraud is that GH¢500,000 of the company’s trade receivables have been stolen by the credit manager and are not recoverable. Of this amount, GH¢200,000 relates to the year ended 30 September 2014 and the remainder to the current year. Kwadaso is not insured against this fraud.

- Corporate income tax payable estimated on the profit for the year is GH¢3,500,000. An amount of GH¢1,200,000 is to be transferred to the deferred taxation account.

Required:

Prepare the following financial statements of Kwadaso Ltd for publication in accordance with International Financial Reporting Standards (IFRS):

a) Statement of profit or loss and other comprehensive income for the year ended 30 September 2015.

b) Statement of changes in equity for the year ended 30 September 2015.

c) Statement of financial position as at 30 September 2015.

d) Show clearly all relevant workings.

(Note: Accounting policy notes are not required)

Find Related Questions by Tags, levels, etc.

- 20 Marks

FR – Nov 2015 – L2 – Q1 – Preparation of Financial Statements

This question requires recalculating DX Ltd’s profit for the year ended March 31, 2015, considering adjustments for sales, depreciation, fraud, and tax.

Question

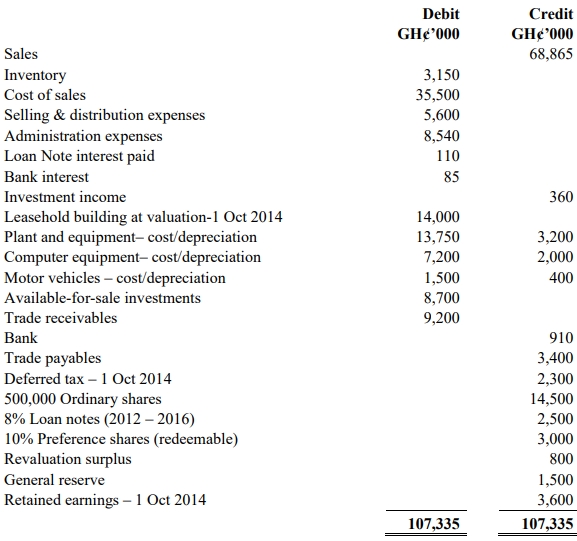

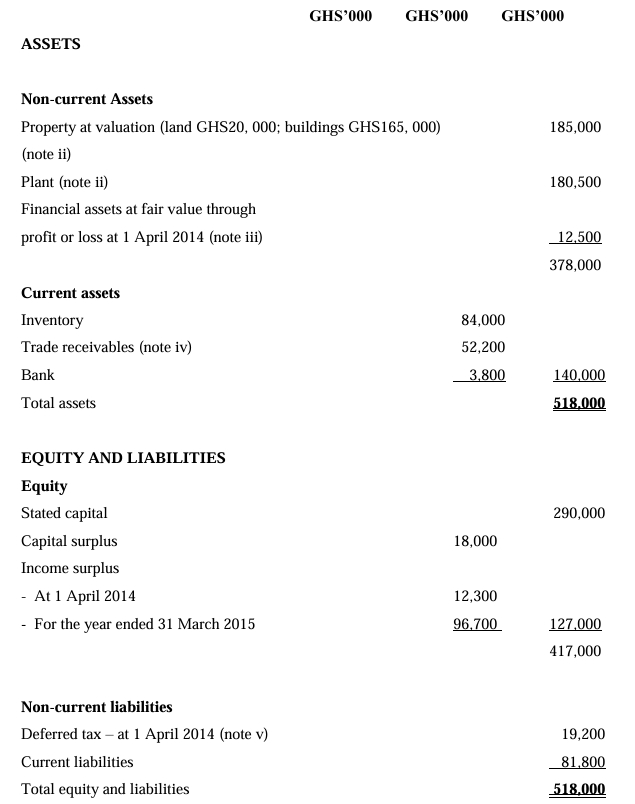

Below is the summarised draft statement of financial position of DX Ltd, a company listed on the Ghana Stock Exchange, as at 31 March, 2015:

The following information is relevant:

- DX Ltd’s statement of profit or loss includes GHS8 million of revenue for credit sales made on a ‘sale or return’ basis. At 31 March 2015, customers who had not paid for the goods had the right to return GHS2.6 million of them. DX Ltd applied a mark-up on cost of 30% on all these sales. In the past, DX Ltd’s customers have sometimes returned goods under this type of agreement.

- The non-current assets have not been depreciated for the year ended 31 March 2015.

DX Ltd has a policy of revaluing its land and buildings at the end of each accounting year. The values in the above statement of financial position as at 1 April 2014 when the building had a remaining life of 15 years. A qualified surveyor has valued the land and buildings at 31 March 2015 at GHS180 million.

Plant is depreciated at 20% on the reducing balance basis. - The financial assets at fair value through profit or loss are held in a fund whose value changes directly in proportion to a specified market index. At 1 April 2014 the relevant index was 1,200, and at 31 March 2015, it was 1,296.

- In late March 2015, the directors of DX Ltd discovered a material fraud perpetrated by the company’s credit controller that had been continuing for some time. Investigations revealed that a total of GHS4 million of the trade receivables as shown in the statement of financial position at 31 March 2015 had in fact been paid, and the money had been stolen by the credit controller. An analysis revealed that GHS1.5 million had been stolen in the year to 31 March 2014, with the rest being stolen in the current year. DX Ltd is not insured for this loss, and it cannot be recovered from the credit controller, nor is it deductible for tax purposes.

- During the year, the company’s taxable temporary differences increased by GHS10 million, of which GHS6 million related to the revaluation of the property. The deferred tax relating to the remainder of the increase in the temporary differences should be taken to profit and loss. The applicable income tax rate is 20%.

- The above figures do not include the estimated provision for income tax on the profit for the year ended 31 March 2015. After allowing for any adjustments required in terms (i) to (iv), the directors have estimated the provision of GHS11.4 million (this is in addition to the deferred tax effects of item (v)).

- During the year, dividends of GHS15.5 million were paid. These have been correctly accounted for in the above statement of financial position.

Required:

Taking into account any adjustments required by items (i) to (vii) above:

a) Prepare a statement showing the recalculation of DX Ltd’s profit for the year ended 31 March 2015. (7 marks)

b) Redraft the statement of financial position of DX Ltd as at 31 March 2015. (13 marks)

(Notes to the financial statements are not required).

(Total: 20 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Deferred Tax, Depreciation, Fraud, Profit recalculation, sale-or-return

- Level: Level 2

- Topic: Presentation of financial statements

- Series: NOV 2015

- 3 Marks

CR – May 2018 – L3 – Q4b – Presentation of financial statements

Explain three problems that arise when using ratios to compare the performance of two companies.

Question

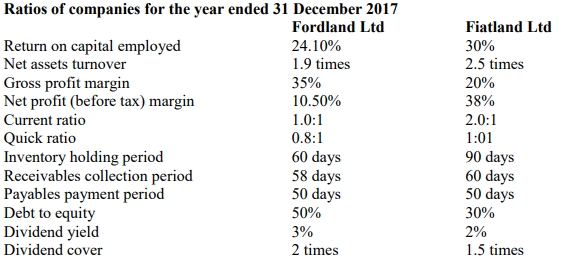

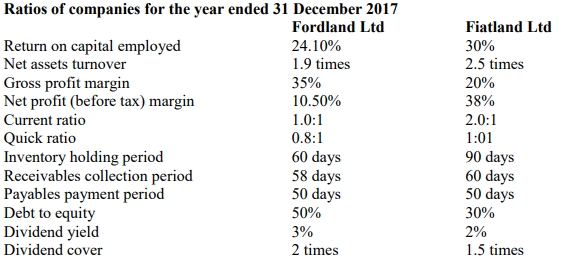

Fordland Ltd and Fiatland Ltd are two companies in the garment industry. The following are financial ratios computed by the Research Department of ICAG as part of analyzing companies’ performance industry by industry.

Required:

Explain THREE problems that are inherent when ratios are used to compare the performance of two companies, even in the same industry.

Find Related Questions by Tags, levels, etc.

- 15 Marks

CR – Nov 2017 – L3 – Q4 – Presentation of financial statements

Prepare a statement of changes in equity for Ahomka Ltd for the years ended 30 April 2016 and 2017.

Question

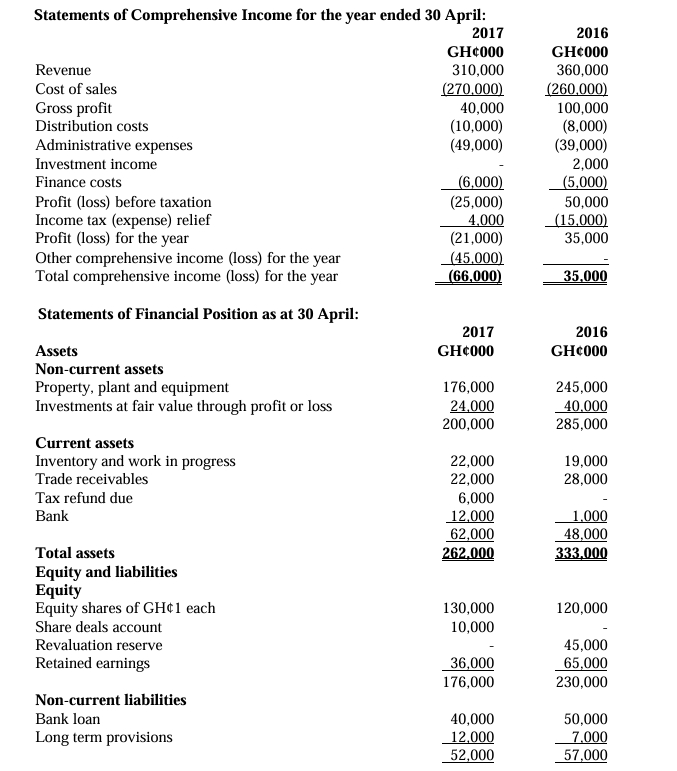

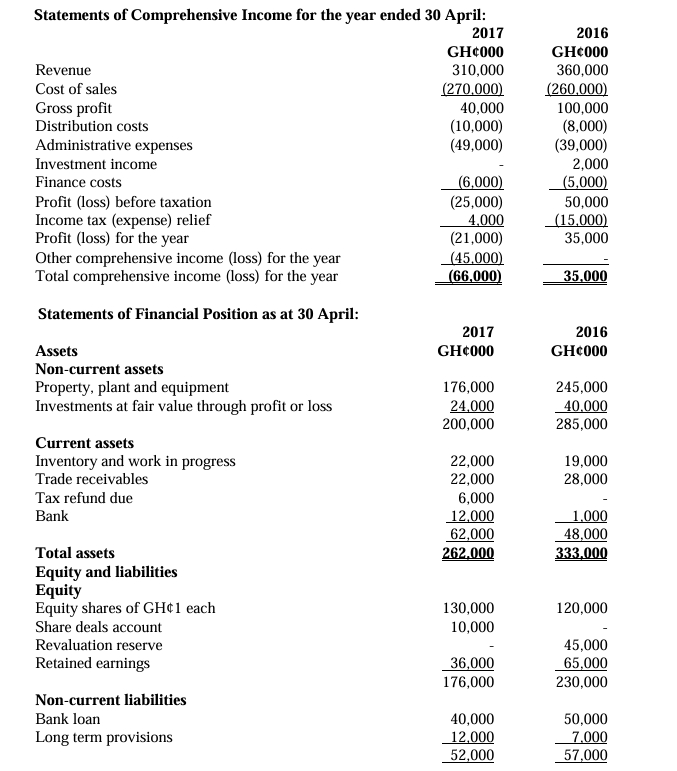

Ahomka Ltd is a public listed manufacturing company. Its summarised financial statements for the year ended 30 April 2017 (and 2016 comparatives) are as follows:

The following additional information is available:

i) There were no additions to, or disposals of, non-current assets during the year.

ii) In order to help cash flows, the company made a rights issue of shares during the year ending 30 April 2017, all of which ranked for dividend. No shares were issued during the year ended 30 April 2016.

iii) The dividend per share has been reduced by 50% for the year ended 30 April 2017.

Required:

a) Prepare a statement of changes in equity for years ended 30 April 2016 and 2017 for Ahomka Ltd as the above information permits.

b) Analyze and discuss the financial performance and financial position of Ahomka Ltd as portrayed in the financial statements and in the additional information provided. Your analysis should be supported by relevant ratios.

Find Related Questions by Tags, levels, etc.

- 20 Marks

FR – March 2024 – L2 – Q3 – Preparation of Financial Statements

Preparation of the statement of comprehensive income for Skolom Ltd.

Question

The following figures have been extracted from the accounting records of Skolom Ltd on 31 December 2022:

Additional information provided includes notes on Skolom Ltd’s agency arrangements with Keke Ltd, joint venture details, and depreciation policies.

Required:

Prepare for Skolom Ltd in accordance with International Financial Reporting Standards (IFRSs):

a) Statement of Comprehensive Income for the year ended 31 December 2022

b) Statement of Financial Position as at 31 December 2022

Find Related Questions by Tags, levels, etc.

- 20 Marks

FR – Nov 2016 – L2 – Q3 – Preparation of Financial Statements

Prepare the financial statements of Kwadaso Ltd, including profit or loss, changes in equity, and financial position for the year ended 30 September 2015.

Question

The following is the trial balance of Kwadaso Ltd, a trading company, as at 30 September 2015:

Additional Information:

- On 31 March 2015, the company made a bonus issue from retained earnings of one new share for every four shares in issue at GH¢10.00 each. This transaction is yet to be recorded in the books. The company paid ordinary dividends of GH¢2.2 per share on 31 January 2015 and GH¢2.6 per share on 30 June 2015. The dividend payments are included in administrative expenses in the trial balance.

- Provision is to be made for a full year’s interest on the Loan notes.

- The finance charge relating to the preference shares is equal to the dividend payable.

- Non-current assets:

- Depreciation of Property, Plant, and Equipment is to be provided on the following bases:

- Plant and equipment – 10% on cost

- Computer equipment – 25% on cost

- Motor vehicles – 20% on reducing balance

- No depreciation has yet been charged on any non-current asset for the year ended 30 September 2015.

- Kwadaso revalues its buildings at the end of each accounting year. At 30 September 2015, the relevant value to be incorporated into the financial statements is GH¢14,100,000. The building’s remaining life at the beginning of the current year (1 October 2014) was 25 years. Kwadaso does not make an annual transfer from the revaluation reserve to retained earnings in respect of the realisation of the revaluation surplus. Ignore deferred tax on the revaluation surplus.

- Depreciation of Property, Plant, and Equipment is to be provided on the following bases:

- The available-for-sale investments held at 30 September 2015 had a fair value of GH¢8,400,000. There were no acquisitions or disposals of these investments during the year.

- In February 2015, Kwadaso’s internal audit unit discovered a fraud committed by the company’s credit manager who did not return from a foreign business trip. The outcome of the fraud is that GH¢500,000 of the company’s trade receivables have been stolen by the credit manager and are not recoverable. Of this amount, GH¢200,000 relates to the year ended 30 September 2014 and the remainder to the current year. Kwadaso is not insured against this fraud.

- Corporate income tax payable estimated on the profit for the year is GH¢3,500,000. An amount of GH¢1,200,000 is to be transferred to the deferred taxation account.

Required:

Prepare the following financial statements of Kwadaso Ltd for publication in accordance with International Financial Reporting Standards (IFRS):

a) Statement of profit or loss and other comprehensive income for the year ended 30 September 2015.

b) Statement of changes in equity for the year ended 30 September 2015.

c) Statement of financial position as at 30 September 2015.

d) Show clearly all relevant workings.

(Note: Accounting policy notes are not required)

Find Related Questions by Tags, levels, etc.

- 20 Marks

FR – Nov 2015 – L2 – Q1 – Preparation of Financial Statements

This question requires recalculating DX Ltd’s profit for the year ended March 31, 2015, considering adjustments for sales, depreciation, fraud, and tax.

Question

Below is the summarised draft statement of financial position of DX Ltd, a company listed on the Ghana Stock Exchange, as at 31 March, 2015:

The following information is relevant:

- DX Ltd’s statement of profit or loss includes GHS8 million of revenue for credit sales made on a ‘sale or return’ basis. At 31 March 2015, customers who had not paid for the goods had the right to return GHS2.6 million of them. DX Ltd applied a mark-up on cost of 30% on all these sales. In the past, DX Ltd’s customers have sometimes returned goods under this type of agreement.

- The non-current assets have not been depreciated for the year ended 31 March 2015.

DX Ltd has a policy of revaluing its land and buildings at the end of each accounting year. The values in the above statement of financial position as at 1 April 2014 when the building had a remaining life of 15 years. A qualified surveyor has valued the land and buildings at 31 March 2015 at GHS180 million.

Plant is depreciated at 20% on the reducing balance basis. - The financial assets at fair value through profit or loss are held in a fund whose value changes directly in proportion to a specified market index. At 1 April 2014 the relevant index was 1,200, and at 31 March 2015, it was 1,296.

- In late March 2015, the directors of DX Ltd discovered a material fraud perpetrated by the company’s credit controller that had been continuing for some time. Investigations revealed that a total of GHS4 million of the trade receivables as shown in the statement of financial position at 31 March 2015 had in fact been paid, and the money had been stolen by the credit controller. An analysis revealed that GHS1.5 million had been stolen in the year to 31 March 2014, with the rest being stolen in the current year. DX Ltd is not insured for this loss, and it cannot be recovered from the credit controller, nor is it deductible for tax purposes.

- During the year, the company’s taxable temporary differences increased by GHS10 million, of which GHS6 million related to the revaluation of the property. The deferred tax relating to the remainder of the increase in the temporary differences should be taken to profit and loss. The applicable income tax rate is 20%.

- The above figures do not include the estimated provision for income tax on the profit for the year ended 31 March 2015. After allowing for any adjustments required in terms (i) to (iv), the directors have estimated the provision of GHS11.4 million (this is in addition to the deferred tax effects of item (v)).

- During the year, dividends of GHS15.5 million were paid. These have been correctly accounted for in the above statement of financial position.

Required:

Taking into account any adjustments required by items (i) to (vii) above:

a) Prepare a statement showing the recalculation of DX Ltd’s profit for the year ended 31 March 2015. (7 marks)

b) Redraft the statement of financial position of DX Ltd as at 31 March 2015. (13 marks)

(Notes to the financial statements are not required).

(Total: 20 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Deferred Tax, Depreciation, Fraud, Profit recalculation, sale-or-return

- Level: Level 2

- Topic: Presentation of financial statements

- Series: NOV 2015

- 3 Marks

CR – May 2018 – L3 – Q4b – Presentation of financial statements

Explain three problems that arise when using ratios to compare the performance of two companies.

Question

Fordland Ltd and Fiatland Ltd are two companies in the garment industry. The following are financial ratios computed by the Research Department of ICAG as part of analyzing companies’ performance industry by industry.

Required:

Explain THREE problems that are inherent when ratios are used to compare the performance of two companies, even in the same industry.

Find Related Questions by Tags, levels, etc.

- 15 Marks

CR – Nov 2017 – L3 – Q4 – Presentation of financial statements

Prepare a statement of changes in equity for Ahomka Ltd for the years ended 30 April 2016 and 2017.

Question

Ahomka Ltd is a public listed manufacturing company. Its summarised financial statements for the year ended 30 April 2017 (and 2016 comparatives) are as follows:

The following additional information is available:

i) There were no additions to, or disposals of, non-current assets during the year.

ii) In order to help cash flows, the company made a rights issue of shares during the year ending 30 April 2017, all of which ranked for dividend. No shares were issued during the year ended 30 April 2016.

iii) The dividend per share has been reduced by 50% for the year ended 30 April 2017.

Required:

a) Prepare a statement of changes in equity for years ended 30 April 2016 and 2017 for Ahomka Ltd as the above information permits.

b) Analyze and discuss the financial performance and financial position of Ahomka Ltd as portrayed in the financial statements and in the additional information provided. Your analysis should be supported by relevant ratios.

Find Related Questions by Tags, levels, etc.